Summary

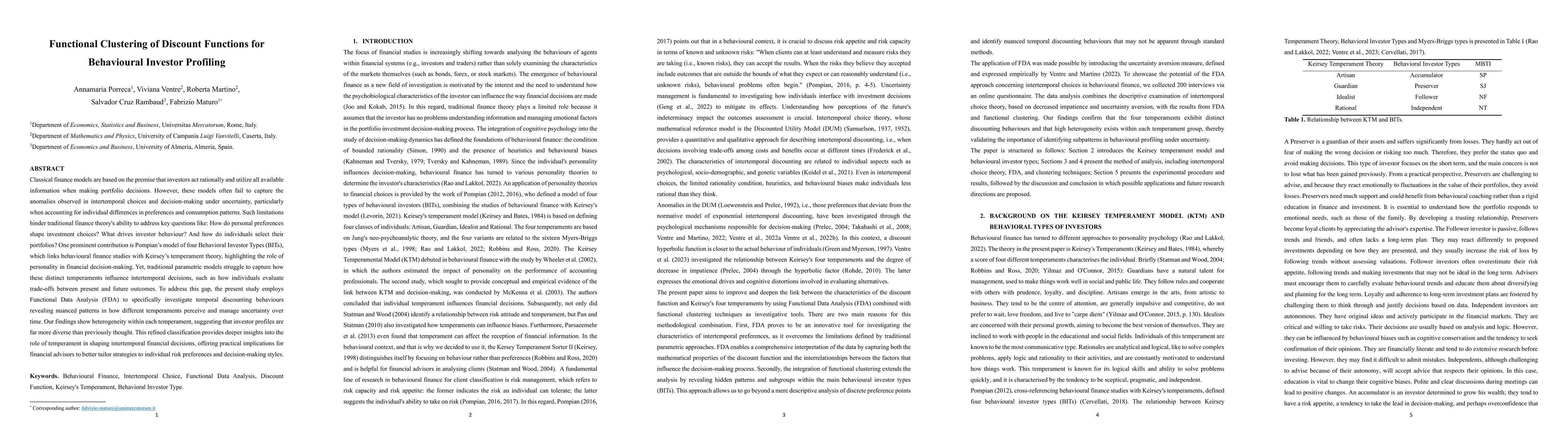

Classical finance models are based on the premise that investors act rationally and utilize all available information when making portfolio decisions. However, these models often fail to capture the anomalies observed in intertemporal choices and decision-making under uncertainty, particularly when accounting for individual differences in preferences and consumption patterns. Such limitations hinder traditional finance theory's ability to address key questions like: How do personal preferences shape investment choices? What drives investor behaviour? And how do individuals select their portfolios? One prominent contribution is Pompian's model of four Behavioral Investor Types (BITs), which links behavioural finance studies with Keirsey's temperament theory, highlighting the role of personality in financial decision-making. Yet, traditional parametric models struggle to capture how these distinct temperaments influence intertemporal decisions, such as how individuals evaluate trade-offs between present and future outcomes. To address this gap, the present study employs Functional Data Analysis (FDA) to specifically investigate temporal discounting behaviours revealing nuanced patterns in how different temperaments perceive and manage uncertainty over time. Our findings show heterogeneity within each temperament, suggesting that investor profiles are far more diverse than previously thought. This refined classification provides deeper insights into the role of temperament in shaping intertemporal financial decisions, offering practical implications for financial advisors to better tailor strategies to individual risk preferences and decision-making styles.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)