Authors

Summary

Tests for structural breaks in time series should ideally be sensitive to breaks in the parameter of interest, while being robust to nuisance changes. Statistical analysis thus needs to allow for some form of nonstationarity under the null hypothesis of no change. In this paper, estimators for integrated parameters of locally stationary time series are constructed and a corresponding functional central limit theorem is established, enabling change-point inference for a broad class of parameters under mild assumptions. The proposed framework covers all parameters which may be expressed as nonlinear functions of moments, for example kurtosis, autocorrelation, and coefficients in a linear regression model. To perform feasible inference based on the derived limit distribution, a bootstrap variant is proposed and its consistency is established. The methodology is illustrated by means of a simulation study and by an application to high-frequency asset prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

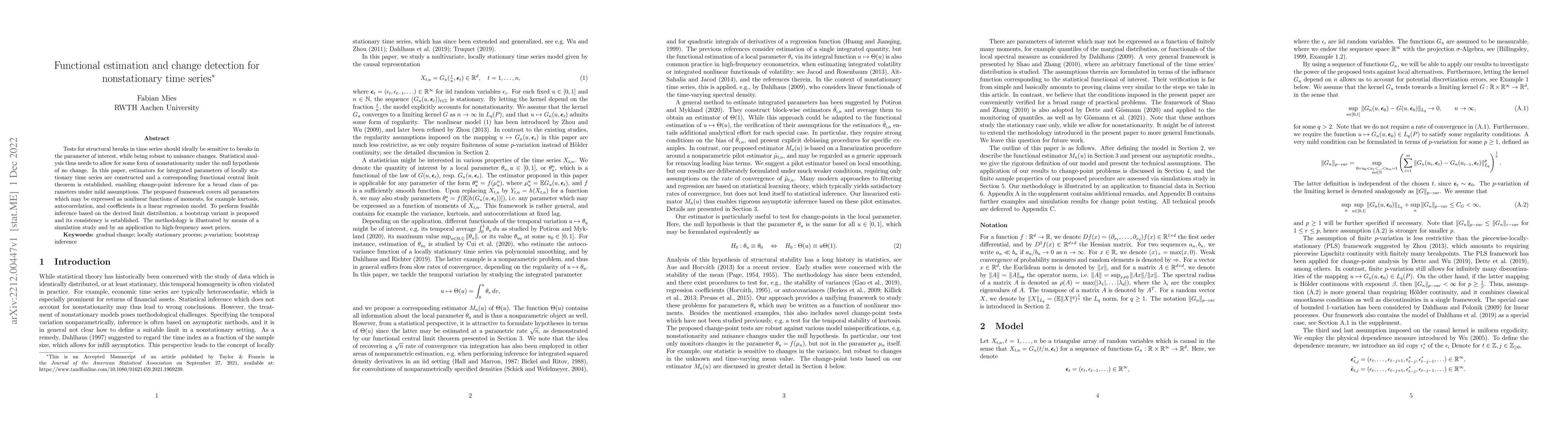

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)