Summary

We provide a surprising new application of classical approximation theory to a fundamental asset-pricing model of mathematical finance. Specifically, we calculate an analytic value for the correlation coefficient between exponential Brownian motion and its time average, and we find the use of divided differences greatly elucidates formulae, providing a path to several new results. As applications, we find that this correlation coefficient is always at least $1/\sqrt{2}$ and, via the Hermite--Genocchi integral relation, demonstrate that all moments of the time average are certain divided differences of the exponential function. We also prove that these moments agree with the somewhat more complex formulae obtained by Oshanin and Yor.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

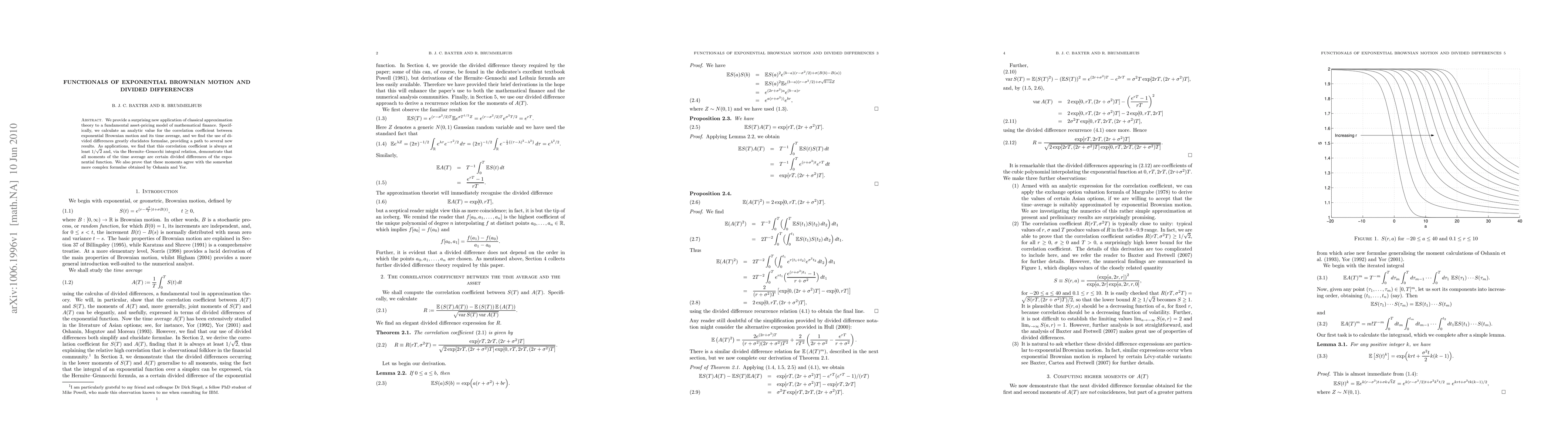

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)