Authors

Summary

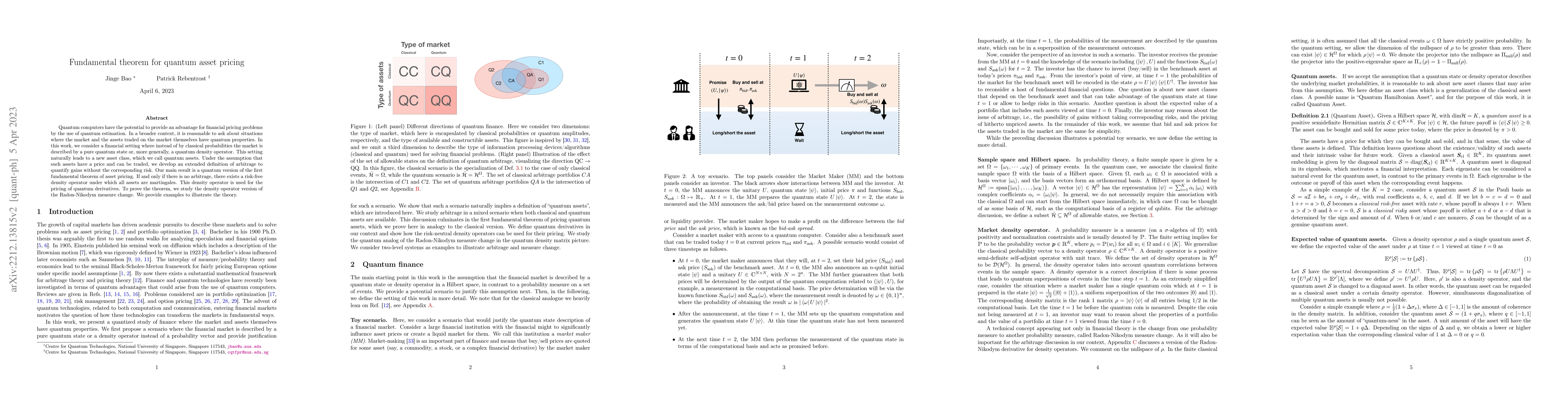

Quantum computers have the potential to provide an advantage for financial pricing problems by the use of quantum estimation. In a broader context, it is reasonable to ask about situations where the market and the assets traded on the market themselves have quantum properties. In this work, we consider a financial setting where instead of by classical probabilities the market is described by a pure quantum state or, more generally, a quantum density operator. This setting naturally leads to a new asset class, which we call quantum assets. Under the assumption that such assets have a price and can be traded, we develop an extended definition of arbitrage to quantify gains without the corresponding risk. Our main result is a quantum version of the first fundamental theorem of asset pricing. If and only if there is no arbitrage, there exists a risk-free density operator under which all assets are martingales. This density operator is used for the pricing of quantum derivatives. To prove the theorem, we study the density operator version of the Radon-Nikodym measure change. We provide examples to illustrate the theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantitative Fundamental Theorem of Asset Pricing

Gudmund Pammer, Beatrice Acciaio, Julio Backhoff

| Title | Authors | Year | Actions |

|---|

Comments (0)