Summary

The log-Lindley distribution was recently introduced in the literature as a viable alternative to the Beta distribution. This distribution has a simple structure and possesses useful theoretical properties relevant in insurance. Classical estimation methods have been well studied. We introduce estimation of parameters from Bayesian point of view for this distribution. Explicit structure of stress-strength reliability and its inference under both classical and Bayesian set-up is addressed. Extensive simulation studies show marked improvement with Bayesian approach over classical given reasonable prior information. An application of a useful metric of discrepancy derived from stress-strength reliability is considered and computed for two categories of firm with respect to a certain financial indicator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

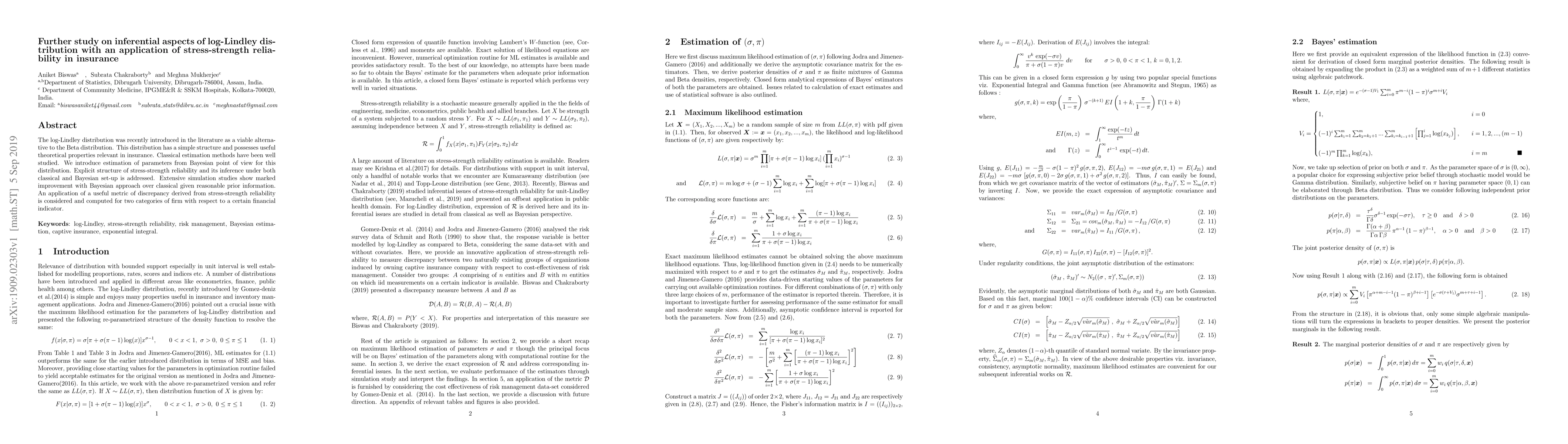

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)