Summary

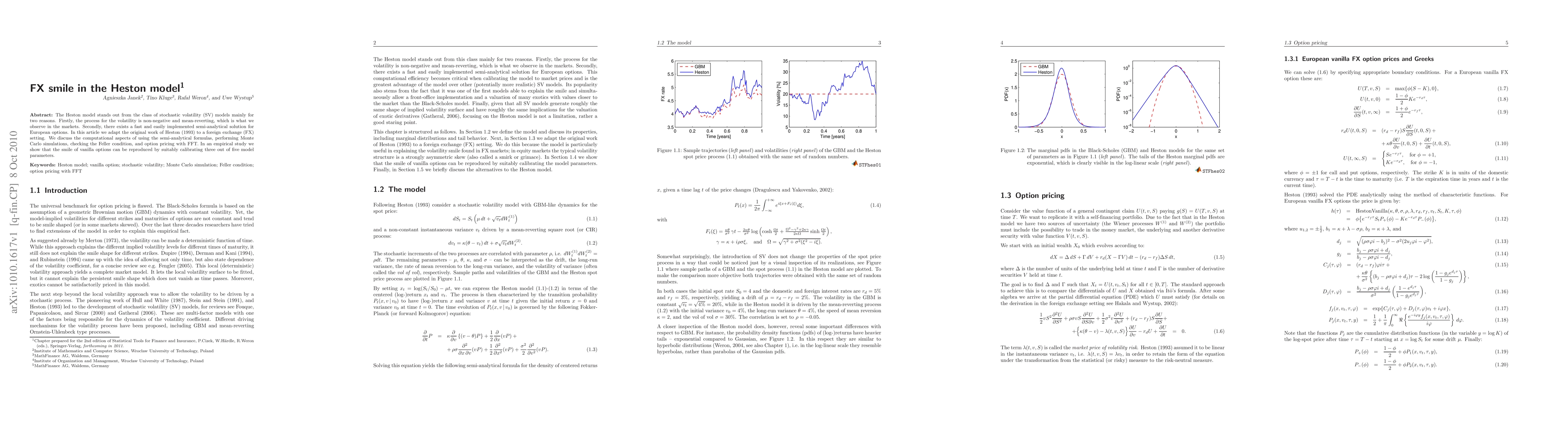

The Heston model stands out from the class of stochastic volatility (SV) models mainly for two reasons. Firstly, the process for the volatility is non-negative and mean-reverting, which is what we observe in the markets. Secondly, there exists a fast and easily implemented semi-analytical solution for European options. In this article we adapt the original work of Heston (1993) to a foreign exchange (FX) setting. We discuss the computational aspects of using the semi-analytical formulas, performing Monte Carlo simulations, checking the Feller condition, and option pricing with FFT. In an empirical study we show that the smile of vanilla options can be reproduced by suitably calibrating three out of five model parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)