Summary

The target of this paper is to establish the bid-ask pricing frame work for the American contingent claims against risky assets with G-asset price systems (see \cite{Chen2013b}) on the financial market under Knight uncertainty. First, we prove G-Dooby-Meyer decomposition for G-supermartingale. Furthermore, we consider bid-ask pricing American contingent claims under Knight uncertain, by using G-Dooby-Meyer decomposition, we construct dynamic superhedge stragies for the optimal stopping problem, and prove that the value functions of the optimal stopping problems are the bid and ask prices of the American contingent claims under Knight uncertain. Finally, we consider a free boundary problem, prove the strong solution existence of the free boundary problem, and derive that the value function of the optimal stopping problem is equivalent to the strong solution to the free boundary problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

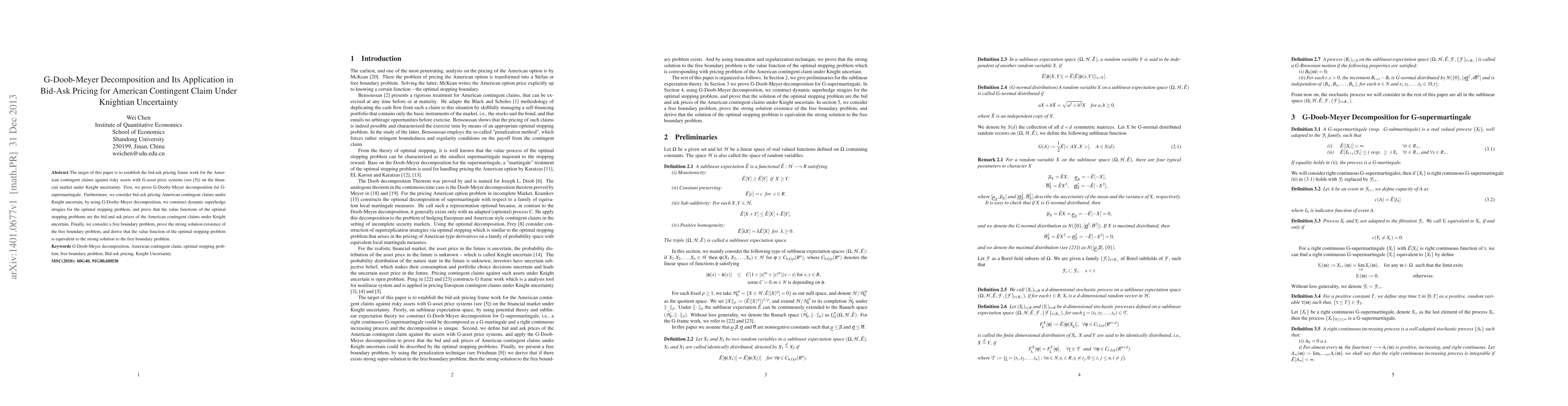

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)