Authors

Summary

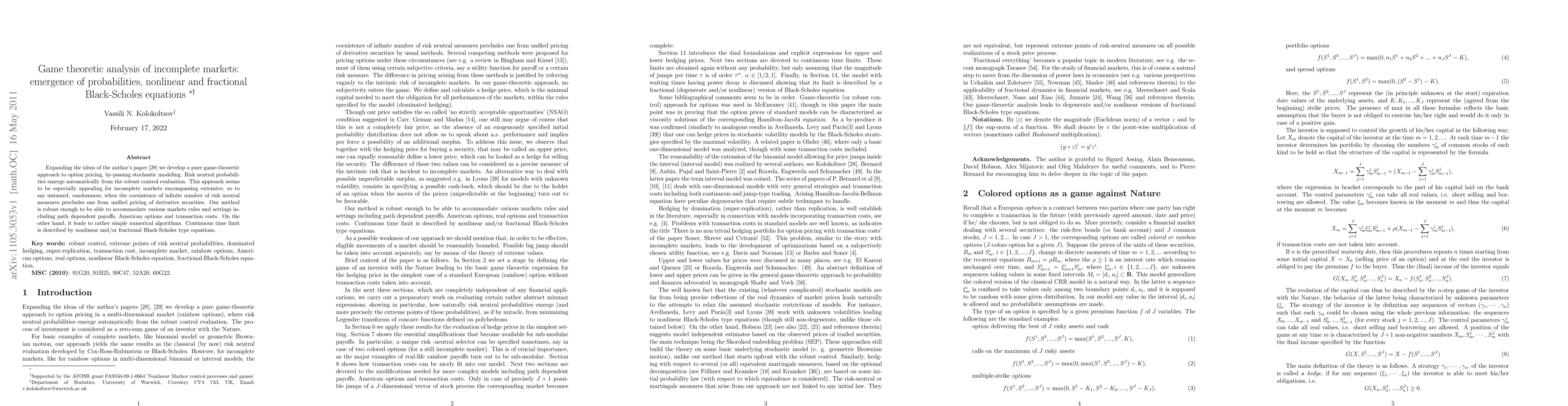

Expanding the ideas of the author's paper 'Nonexpansive maps and option pricing theory' (Kibernetica 34:6 (1998), 713-724) we develop a pure game-theoretic approach to option pricing, by-passing stochastic modeling. Risk neutral probabilities emerge automatically from the robust control evaluation. This approach seems to be especially appealing for incomplete markets encompassing extensive, so to say untamed, randomness, when the coexistence of infinite number of risk neutral measures precludes one from unified pricing of derivative securities. Our method is robust enough to be able to accommodate various markets rules and settings including path dependent payoffs, American options and transaction costs. On the other hand, it leads to rather simple numerical algorithms. Continuous time limit is described by nonlinear and/or fractional Black-Scholes type equations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)