Summary

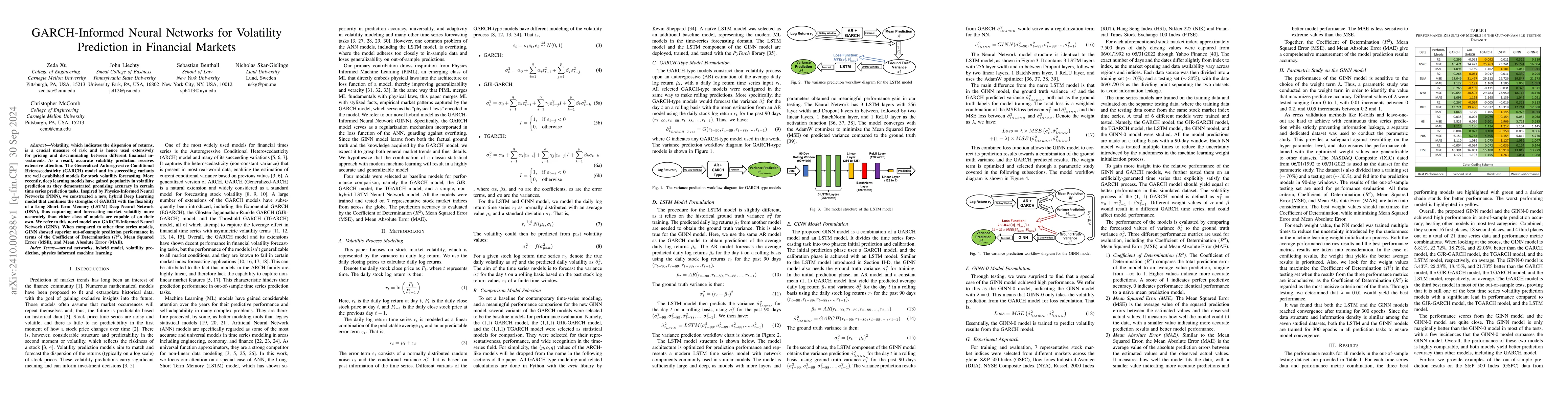

Volatility, which indicates the dispersion of returns, is a crucial measure of risk and is hence used extensively for pricing and discriminating between different financial investments. As a result, accurate volatility prediction receives extensive attention. The Generalized Autoregressive Conditional Heteroscedasticity (GARCH) model and its succeeding variants are well established models for stock volatility forecasting. More recently, deep learning models have gained popularity in volatility prediction as they demonstrated promising accuracy in certain time series prediction tasks. Inspired by Physics-Informed Neural Networks (PINN), we constructed a new, hybrid Deep Learning model that combines the strengths of GARCH with the flexibility of a Long Short-Term Memory (LSTM) Deep Neural Network (DNN), thus capturing and forecasting market volatility more accurately than either class of models are capable of on their own. We refer to this novel model as a GARCH-Informed Neural Network (GINN). When compared to other time series models, GINN showed superior out-of-sample prediction performance in terms of the Coefficient of Determination ($R^2$), Mean Squared Error (MSE), and Mean Absolute Error (MAE).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic graph neural networks for enhanced volatility prediction in financial markets

Nneka Umeorah, Pulikandala Nithish Kumar, Alex Alochukwu

Integrated GARCH-GRU in Financial Volatility Forecasting

Zhenyu Cui, Steve Yang, Jingyi Wei

| Title | Authors | Year | Actions |

|---|

Comments (0)