Summary

In this work, we further explore the forecasting ability of a recently proposed normalizing and variance-stabilizing (NoVaS) transformation after wrapping exogenous variables. In practice, especially in the area of financial econometrics, extra knowledge such as fundamentals- and sentiments-based information could be beneficial to improve the prediction accuracy of market volatility if they are incorporated into the forecasting process. In a classical approach, people usually apply GARCHX-type methods to include the exogenous variables. Being a Model-free prediction method, NoVaS has been shown to be more accurate and stable than classical GARCH-type methods. We are interested in whether the novel NoVaS method can also sustain its superiority after exogenous covariates are taken into account. We provide the NoVaS transformation based on GARCHX model and then claim the corresponding prediction procedure with exogenous variables existing. Also, simulation studies verify that the NoVaS method still outperforms traditional methods, especially for long-term time aggregated predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

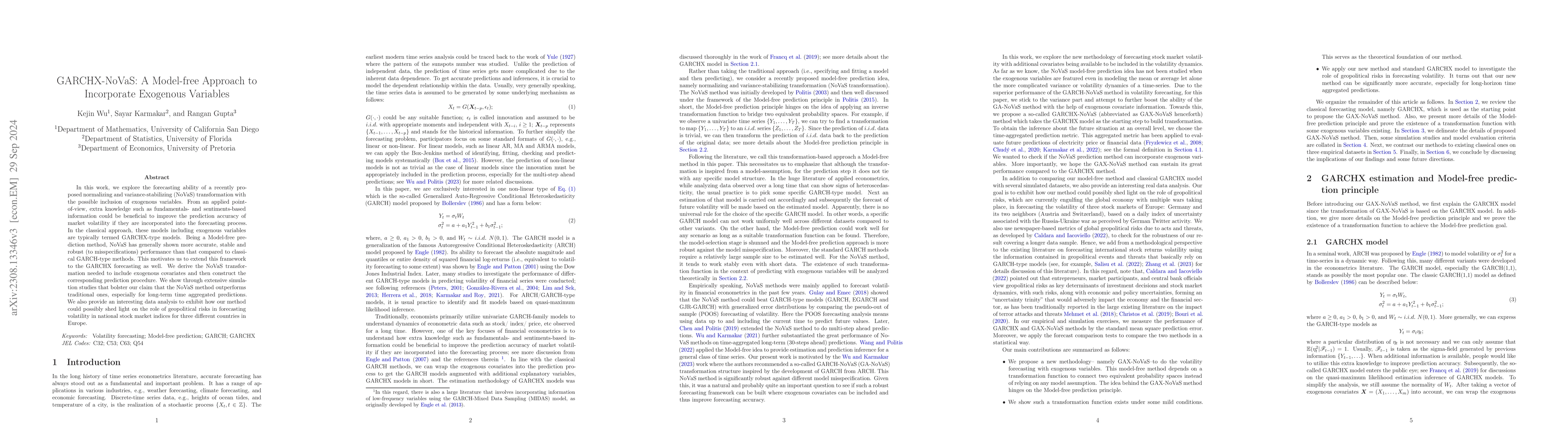

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnticipating dengue outbreaks using a novel hybrid ARIMA-ARNN model with exogenous variables

S. Gupta, I. Ghosh, S. Rana

No citations found for this paper.

Comments (0)