Authors

Summary

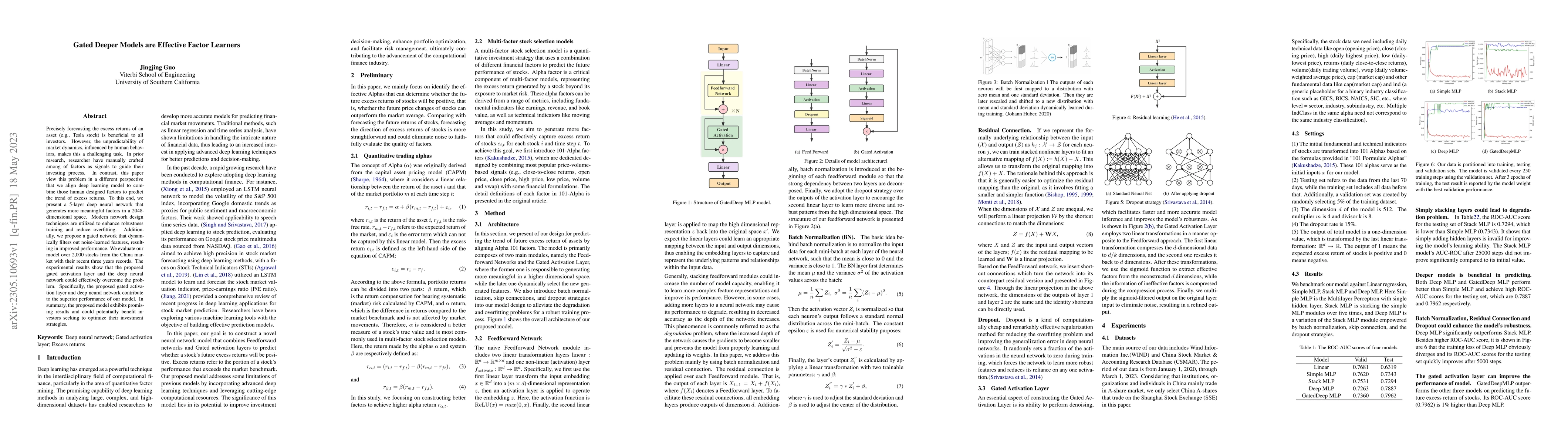

Precisely forecasting the excess returns of an asset (e.g., Tesla stock) is beneficial to all investors. However, the unpredictability of market dynamics, influenced by human behaviors, makes this a challenging task. In prior research, researcher have manually crafted among of factors as signals to guide their investing process. In contrast, this paper view this problem in a different perspective that we align deep learning model to combine those human designed factors to predict the trend of excess returns. To this end, we present a 5-layer deep neural network that generates more meaningful factors in a 2048-dimensional space. Modern network design techniques are utilized to enhance robustness training and reduce overfitting. Additionally, we propose a gated network that dynamically filters out noise-learned features, resulting in improved performance. We evaluate our model over 2,000 stocks from the China market with their recent three years records. The experimental results show that the proposed gated activation layer and the deep neural network could effectively overcome the problem. Specifically, the proposed gated activation layer and deep neural network contribute to the superior performance of our model. In summary, the proposed model exhibits promising results and could potentially benefit investors seeking to optimize their investment strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLanguage models are weak learners

Yiding Jiang, Hariharan Manikandan, J Zico Kolter

ST-LLM: Large Language Models Are Effective Temporal Learners

Ying Shan, Chen Li, Yixiao Ge et al.

Large Language Models Are Universal Recommendation Learners

Jian Xu, Han Zhu, Bo Zheng et al.

No citations found for this paper.

Comments (0)