Summary

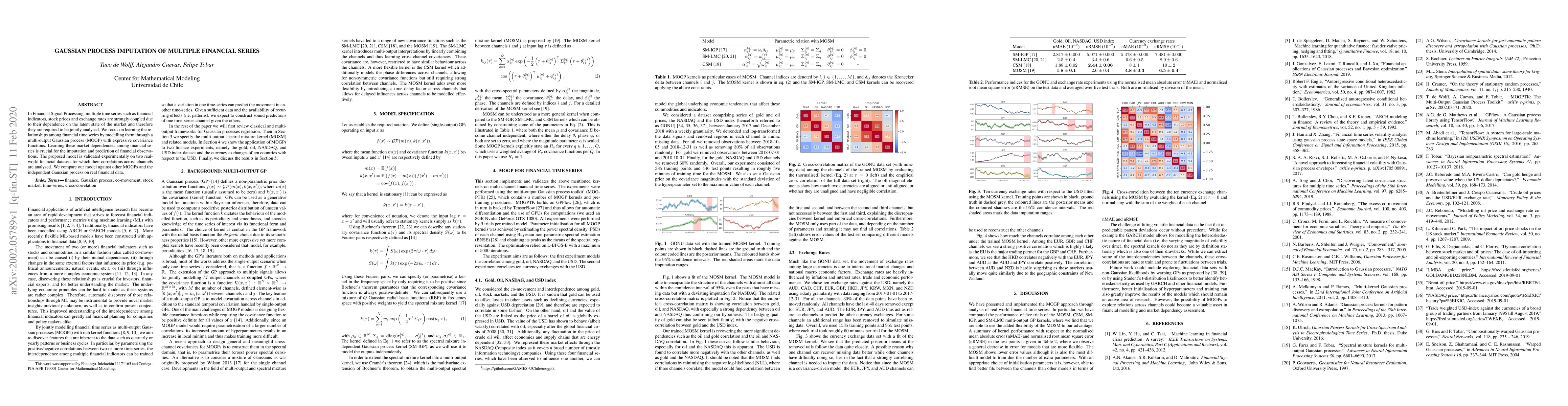

In Financial Signal Processing, multiple time series such as financial indicators, stock prices and exchange rates are strongly coupled due to their dependence on the latent state of the market and therefore they are required to be jointly analysed. We focus on learning the relationships among financial time series by modelling them through a multi-output Gaussian process (MOGP) with expressive covariance functions. Learning these market dependencies among financial series is crucial for the imputation and prediction of financial observations. The proposed model is validated experimentally on two real-world financial datasets for which their correlations across channels are analysed. We compare our model against other MOGPs and the independent Gaussian process on real financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultiple Imputation with Neural Network Gaussian Process for High-dimensional Incomplete Data

Qi Long, Zhiqi Bu, Zongyu Dai

MAGIC: Multi-task Gaussian process for joint imputation and classification in healthcare time series

Jing Li, Visar Berisha, Todd J. Schwedt et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)