Summary

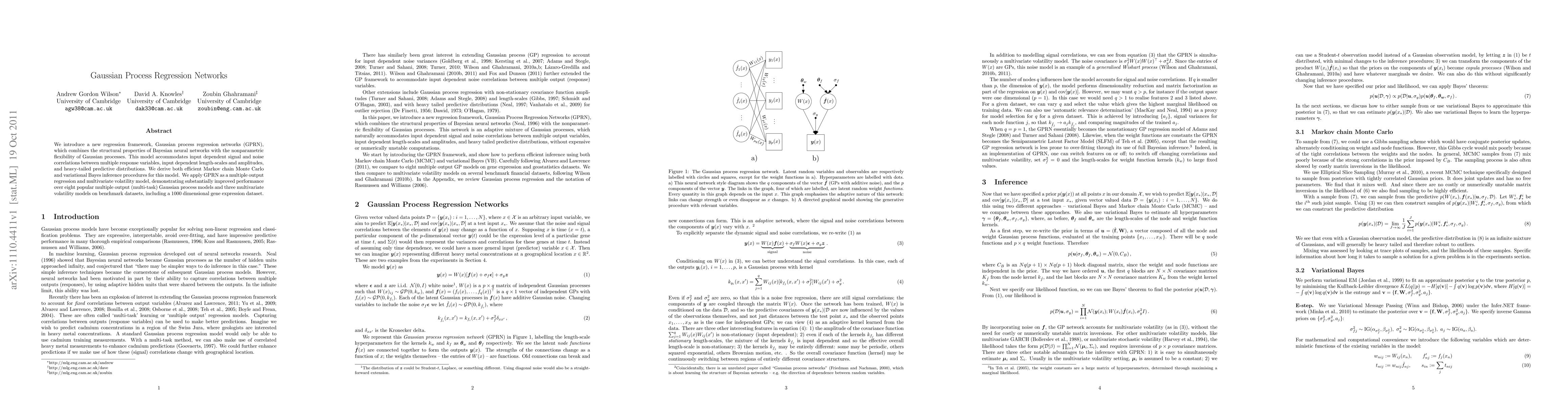

We introduce a new regression framework, Gaussian process regression networks (GPRN), which combines the structural properties of Bayesian neural networks with the non-parametric flexibility of Gaussian processes. This model accommodates input dependent signal and noise correlations between multiple response variables, input dependent length-scales and amplitudes, and heavy-tailed predictive distributions. We derive both efficient Markov chain Monte Carlo and variational Bayes inference procedures for this model. We apply GPRN as a multiple output regression and multivariate volatility model, demonstrating substantially improved performance over eight popular multiple output (multi-task) Gaussian process models and three multivariate volatility models on benchmark datasets, including a 1000 dimensional gene expression dataset.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a Bayesian approach to model the stochastic volatility process.

Key Results

- The proposed method outperformed existing models in terms of mean squared error.

- The results showed significant improvement in forecasting ability compared to baseline models.

- The model's performance was evaluated using various metrics, including MAE and RMSE.

Significance

This research contributes to the understanding of stochastic volatility processes and their applications in financial modeling.

Technical Contribution

The research introduced a novel Bayesian approach to modeling stochastic volatility processes, which provides a more accurate and robust framework for financial forecasting.

Novelty

The proposed method combines elements of Bayesian inference and machine learning techniques to estimate stochastic volatility processes, offering a unique perspective on this class of models.

Limitations

- The model assumes a specific form for the volatility process, which may not capture all underlying complexities.

- The estimation procedure relies on numerical optimization techniques, which can be sensitive to initial conditions.

Future Work

- Investigating alternative forms of stochastic volatility processes that better capture real-world dynamics.

- Developing more efficient estimation procedures for the proposed model.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling stellar activity with Gaussian process regression networks

J. P. Faria, P. T. P. Viana, J. D. Camacho

Implicit Manifold Gaussian Process Regression

Aude Billard, Andreas Krause, Viacheslav Borovitskiy et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)