Summary

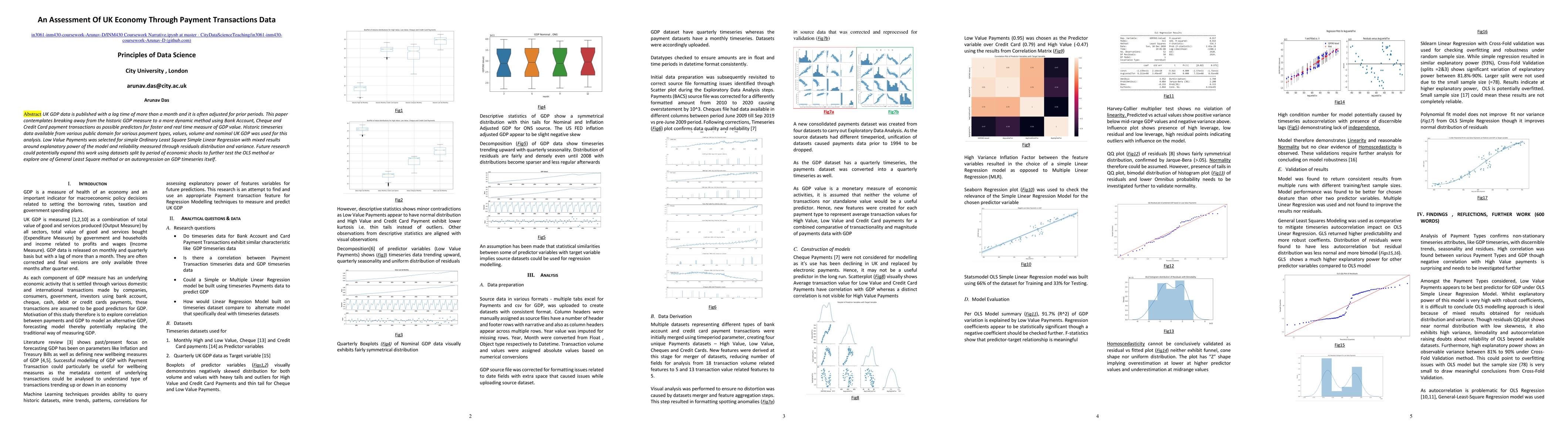

UK GDP data is published with a lag time of more than a month and it is often adjusted for prior periods. This paper contemplates breaking away from the historic GDP measure to a more dynamic method using Bank Account, Cheque and Credit Card payment transactions as possible predictors for faster and real time measure of GDP value. Historic timeseries data available from various public domain for various payment types, values, volume and nominal UK GDP was used for this analysis. Low Value Payments was selected for simple Ordinary Least Square Simple Linear Regression with mixed results around explanatory power of the model and reliability measured through residuals distribution and variance. Future research could potentially expand this work using datasets split by period of economic shocks to further test the OLS method or explore one of General Least Square method or an autoregression on GDP timeseries itself.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting GDP in Europe with Textual Data

Sergio Consoli, Luca Barbaglia, Sebastiano Manzan

GDP nowcasting with large-scale inter-industry payment data in real time -- A network approach

Mihai Cucuringu, Gesine Reinert, Anastasia Mantziou et al.

Bitcoin Transaction Forecasting with Deep Network Representation Learning

Qi Zhang, Ling Liu, Wenqi Wei

| Title | Authors | Year | Actions |

|---|

Comments (0)