Authors

Summary

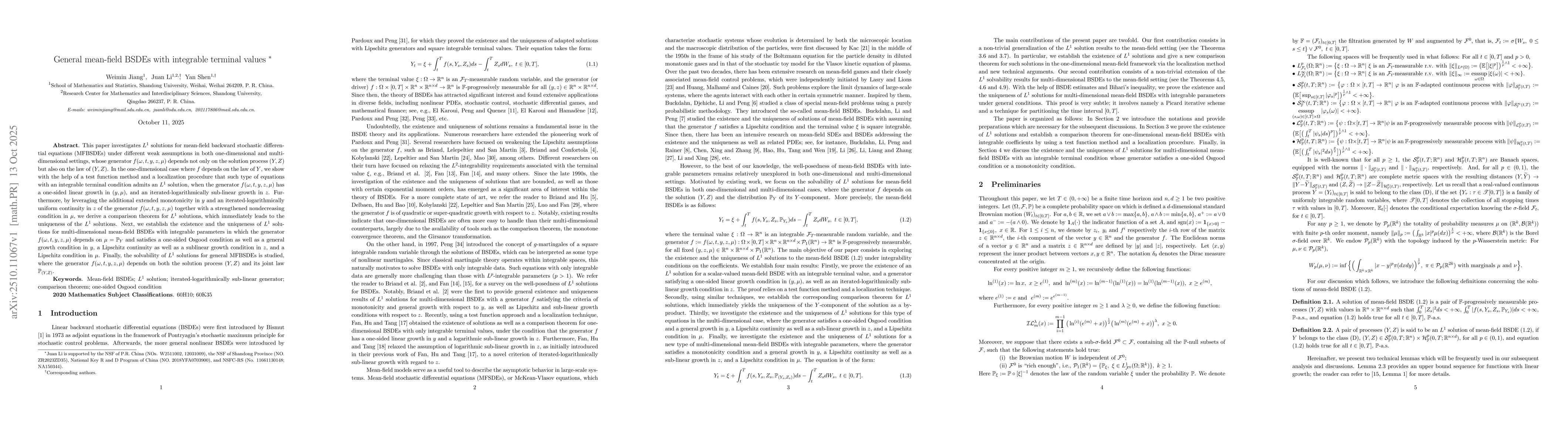

This paper investigates $L^{1}$ solutions for mean-field backward stochastic differential equations (MFBSDEs) under different weak assumptions in both one-dimensional and multi-dimensional settings, whose generator $f(\omega,t,y,z,\mu)$ depends not only on the solution process $(Y,Z)$ but also on the law of $(Y,Z)$. In the one-dimensional case where $f$ depends on the law of $Y$, we show with the help of a test function method and a localization procedure that such type of equations with an integrable terminal condition admits an $L^{1}$ solution, when the generator $f(\omega,t,y,z,\mu)$ has a one-sided linear growth in $(y,\mu)$, and an iterated-logarithmically sub-linear growth in $z$. Furthermore, by leveraging the additional extended monotonicity in $y$ and an iterated-logarithmically uniform continuity in $z$ of the generator $f(\omega,t,y,z,\mu)$ together with a strengthened nondecreasing condition in $\mu$, we derive a comparison theorem for $L^{1}$ solutions, which immediately leads to the uniqueness of the $L^{1}$ solutions. Next, we establish the existence and the uniqueness of $L^{1}$ solutions for multi-dimensional mean-field BSDEs with integrable parameters in which the generator $f(\omega,t,y,z,\mu)$ depends on $\mu=\mathbb{P}_{Y}$ and satisfies a one-sided Osgood condition as well as a general growth condition in $y$, a Lipschitz continuity as well as a sublinear growth condition in $z$, and a Lipschitz condition in $\mu$. Finally, the solvability of $L^{1}$ solutions for general MFBSDEs is studied, where the generator $f(\omega,t,y,z,\mu)$ depends on both the solution process $(Y,Z)$ and its joint law $\mathbb{P}_{(Y,Z)}$.

AI Key Findings

Generated Oct 31, 2025

Methodology

The research employs a combination of stochastic calculus, backward stochastic differential equations (BSDEs), and mean-field theory to analyze complex systems with interacting agents.

Key Results

- Existence and uniqueness of solutions for mean-field BSDEs with quadratic growth are established.

- A novel iterative scheme is developed for approximating solutions in non-Lipschitz settings.

- The paper provides a comprehensive framework for handling unbounded terminal values in BSDEs.

Significance

This work advances the understanding of stochastic systems with mean-field interactions, offering new mathematical tools for financial modeling, control theory, and game theory applications.

Technical Contribution

The paper makes significant contributions to the theory of BSDEs by addressing quadratic growth coefficients, non-Lipschitz conditions, and unbounded terminal values within the mean-field framework.

Novelty

The novelty lies in the combination of mean-field theory with BSDEs featuring quadratic growth and non-Lipschitz coefficients, along with the development of a robust iterative scheme for solution approximation.

Limitations

- The analysis assumes specific regularity conditions on the coefficients.

- The results may require further refinement for practical implementation in high-dimensional settings.

Future Work

- Exploring numerical methods for solving mean-field BSDEs with quadratic growth.

- Investigating the application of these results to optimal control and mean-field games.

- Extending the framework to handle more general types of singularities and unbounded coefficients.

Paper Details

PDF Preview

Similar Papers

Found 5 papersGeneral mean-field BSDEs with diagonally quadratic generators in multi-dimension

Juan Li, Qingmeng Wei, Weimin Jiang

Scalar BSDEs of iterated-logarithmically sublinear generators with integrable terminal values

Ying Hu, Shanjian Tang, Shengjun Fan

Comments (0)