Summary

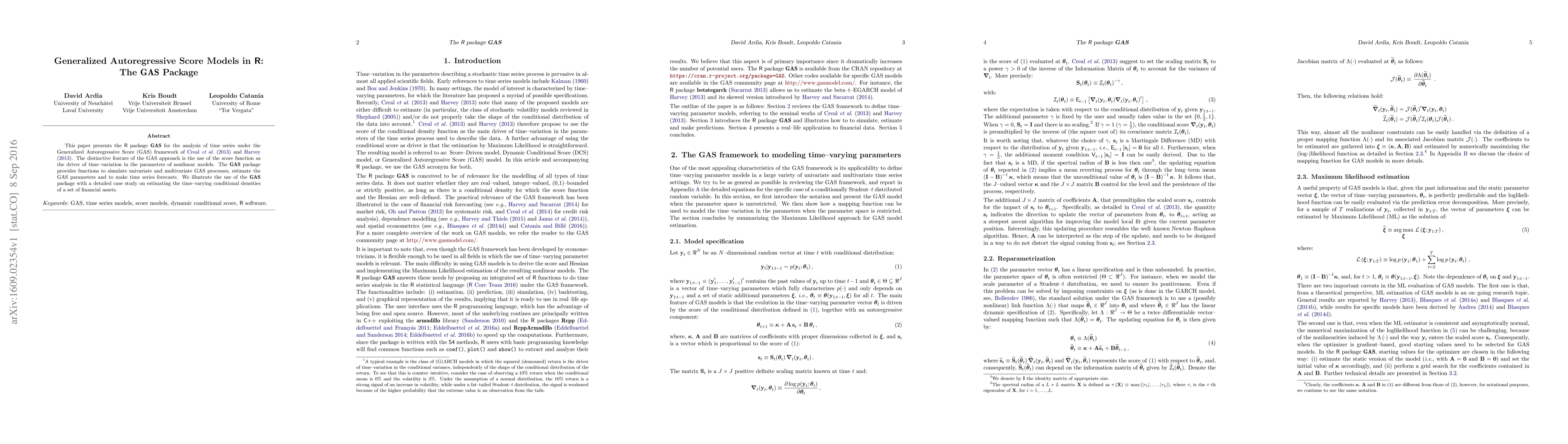

This paper presents the R package GAS for the analysis of time series under the Generalized Autoregressive Score (GAS) framework of Creal et al. (2013) and Harvey (2013). The distinctive feature of the GAS approach is the use of the score function as the driver of time-variation in the parameters of nonlinear models. The GAS package provides functions to simulate univariate and multivariate GAS processes, estimate the GAS parameters and to make time series forecasts. We illustrate the use of the GAS package with a detailed case study on estimating the time-varying conditional densities of a set of financial assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)