Summary

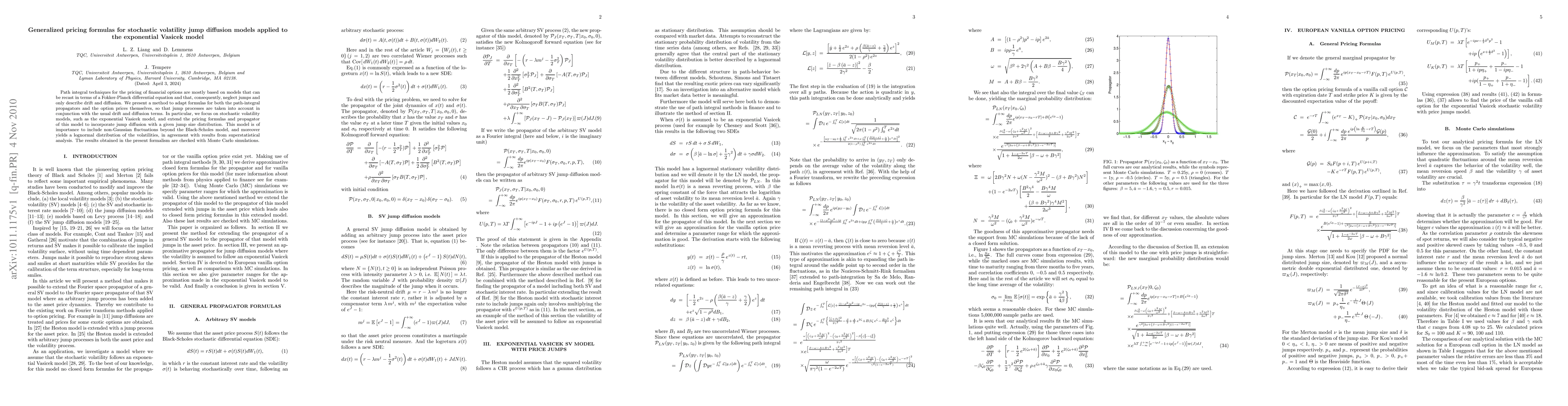

Path integral techniques for the pricing of financial options are mostly based on models that can be recast in terms of a Fokker-Planck differential equation and that, consequently, neglect jumps and only describe drift and diffusion. We present a method to adapt formulas for both the path-integral propagators and the option prices themselves, so that jump processes are taken into account in conjunction with the usual drift and diffusion terms. In particular, we focus on stochastic volatility models, such as the exponential Vasicek model, and extend the pricing formulas and propagator of this model to incorporate jump diffusion with a given jump size distribution. This model is of importance to include non-Gaussian fluctuations beyond the Black-Scholes model, and moreover yields a lognormal distribution of the volatilities, in agreement with results from superstatistical analysis. The results obtained in the present formalism are checked with Monte Carlo simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)