Summary

To convert standard Brownian motion $Z$ into a positive process, Geometric Brownian motion (GBM) $e^{\beta Z_t}, \beta >0$ is widely used. We generalize this positive process by introducing an asymmetry parameter $ \alpha \geq 0$ which describes the instantaneous volatility whenever the process reaches a new low. For our new process, $\beta$ is the instantaneous volatility as prices become arbitrarily high. Our generalization preserves the positivity, constant proportional drift, and tractability of GBM, while expressing the instantaneous volatility as a randomly weighted $L^2$ mean of $\alpha$ and $\beta$. The running minimum and relative drawup of this process are also analytically tractable. Letting $\alpha = \beta$, our positive process reduces to Geometric Brownian motion. By adding a jump to default to the new process, we introduce a non-negative martingale with the same tractabilities. Assuming a security's dynamics are driven by these processes in risk neutral measure, we price several derivatives including vanilla, barrier and lookback options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

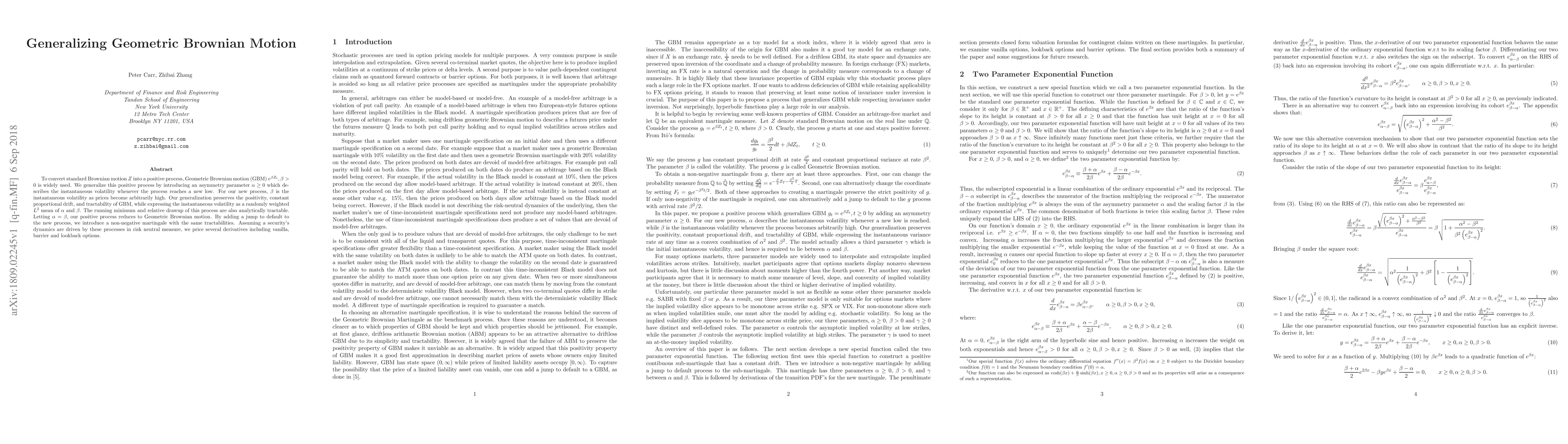

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInfinite ergodicity for geometric Brownian motion

Stefano Giordano, Fabrizio Cleri, Ralf Blossey

| Title | Authors | Year | Actions |

|---|

Comments (0)