Summary

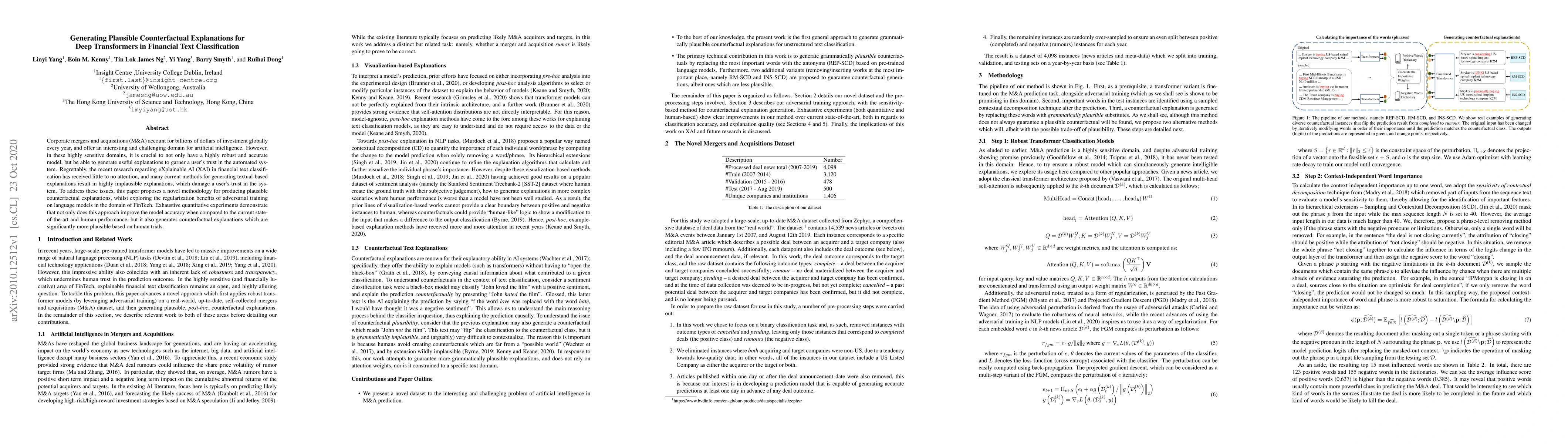

Corporate mergers and acquisitions (M&A) account for billions of dollars of investment globally every year, and offer an interesting and challenging domain for artificial intelligence. However, in these highly sensitive domains, it is crucial to not only have a highly robust and accurate model, but be able to generate useful explanations to garner a user's trust in the automated system. Regrettably, the recent research regarding eXplainable AI (XAI) in financial text classification has received little to no attention, and many current methods for generating textual-based explanations result in highly implausible explanations, which damage a user's trust in the system. To address these issues, this paper proposes a novel methodology for producing plausible counterfactual explanations, whilst exploring the regularization benefits of adversarial training on language models in the domain of FinTech. Exhaustive quantitative experiments demonstrate that not only does this approach improve the model accuracy when compared to the current state-of-the-art and human performance, but it also generates counterfactual explanations which are significantly more plausible based on human trials.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCountARFactuals -- Generating plausible model-agnostic counterfactual explanations with adversarial random forests

Bernd Bischl, Susanne Dandl, Gunnar König et al.

Generating Feasible and Plausible Counterfactual Explanations for Outcome Prediction of Business Processes

Chun Ouyang, Catarina Moreira, Johannes De Smedt et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)