Summary

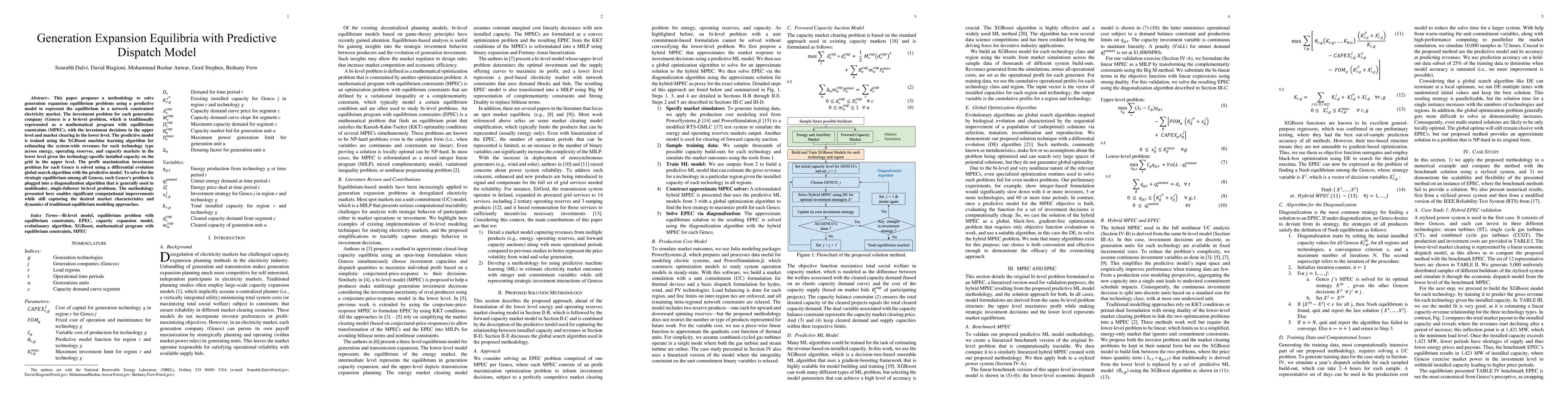

This paper proposes a methodology to solve generation expansion equilibrium problems by using a predictive model to represent the equilibrium in a simplified network constrained electricity market. The investment problem for each generation company (Genco) is a bi-level problem with the investment decision made in the upper level and market clearing condition in the lower level, which traditionally is represented as a Mathematical Program with Equilibrium Constraint (MPEC). The predictive model is trained for estimating the system-wide revenues for each technology type across energy, ancillary services and capacity markets given the amount of technology-specific installed capacity on the grid. The profit maximization investment problem for each Genco is solved using a global search algorithm, which uses the predictive model to evaluate the objective function. To solve for the strategic equilibrium, each Genco's problem is plugged into a diagonalization algorithm that is generally used in multi-leader, single-follower bi-level problems. The methodology presented here enables significant computational improvements while still capturing the desired market characteristics and dynamics of traditional equilibrium modeling approaches

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEconomic Model Predictive Control with a Non-Fixed Reference Trajectory for Optimal Microgrid Dispatch

Avik Ghosh, Adil Khurram, Jan Kleissl et al.

Data-Driven Evolutionary Game-Based Model Predictive Control for Hybrid Renewable Energy Dispatch in Autonomous Ships

Zhen Tian, Zhihao Lin, Jinming Yang et al.

Robust Generation Dispatch with Purchase of Renewable Power and Load Predictions

Yue Chen, Yin Xu, Rui Xie et al.

Koopman-based Differentiable Predictive Control for the Dynamics-Aware Economic Dispatch Problem

Arnab Bhattacharya, Jan Drgona, Draguna Vrabie et al.

No citations found for this paper.

Comments (0)