Summary

Modelling in finance is a challenging task: the data often has complex statistical properties and its inner workings are largely unknown. Deep learning algorithms are making progress in the field of data-driven modelling, but the lack of sufficient data to train these models is currently holding back several new applications. Generative Adversarial Networks (GANs) are a neural network architecture family that has achieved good results in image generation and is being successfully applied to generate time series and other types of financial data. The purpose of this study is to present an overview of how these GANs work, their capabilities and limitations in the current state of research with financial data, and present some practical applications in the industry. As a proof of concept, three known GAN architectures were tested on financial time series, and the generated data was evaluated on its statistical properties, yielding solid results. Finally, it was shown that GANs have made considerable progress in their finance applications and can be a solid additional tool for data scientists in this field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

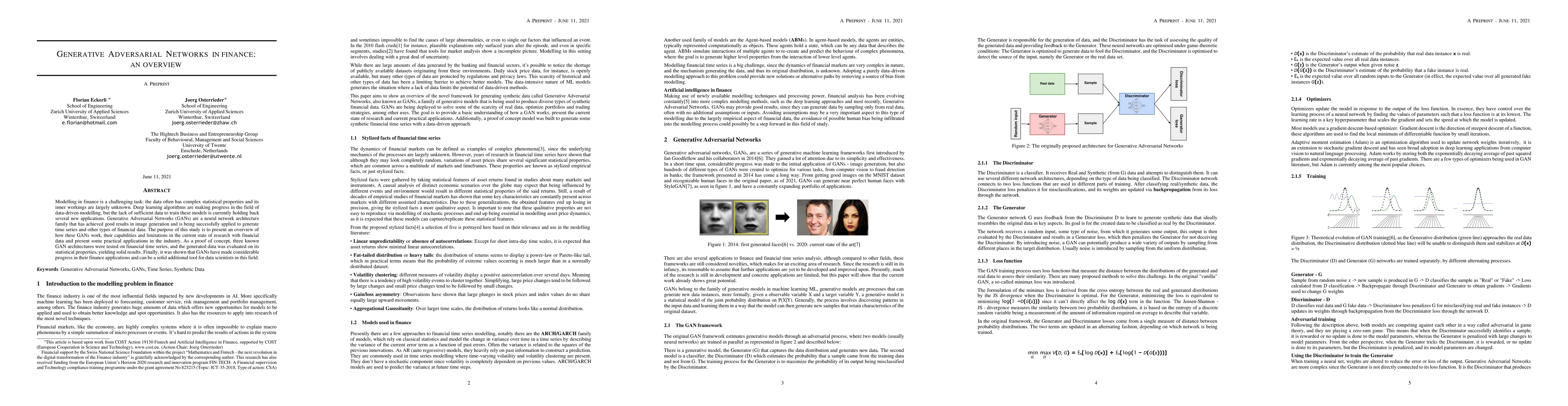

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMutual Information Maximizing Quantum Generative Adversarial Network and Its Applications in Finance

Mingyu Lee, Junseo Lee, Kabgyun Jeong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)