Summary

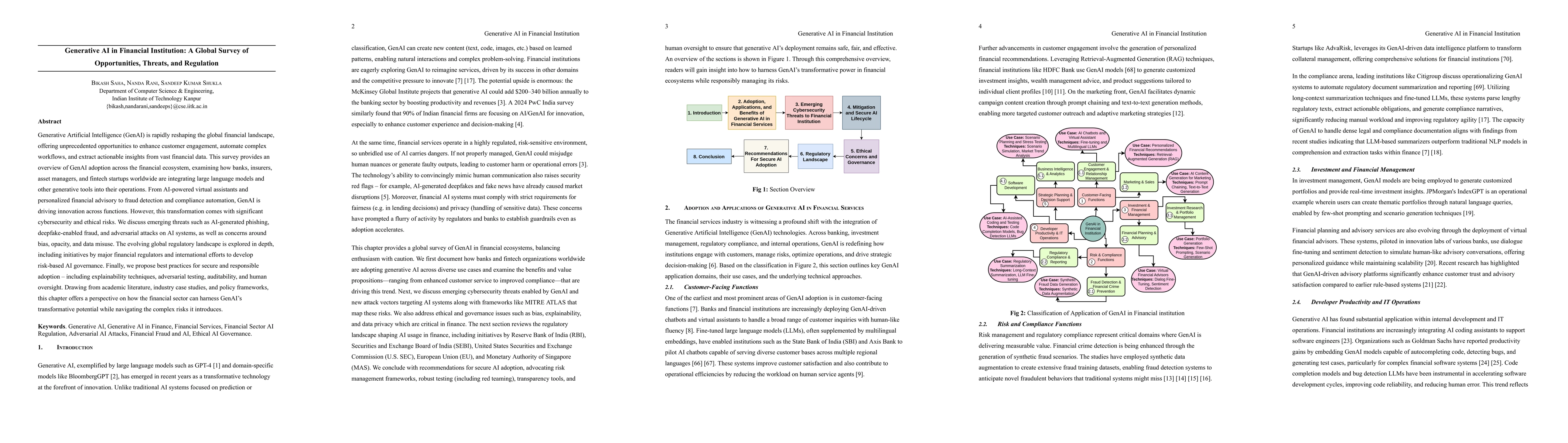

Generative Artificial Intelligence (GenAI) is rapidly reshaping the global financial landscape, offering unprecedented opportunities to enhance customer engagement, automate complex workflows, and extract actionable insights from vast financial data. This survey provides an overview of GenAI adoption across the financial ecosystem, examining how banks, insurers, asset managers, and fintech startups worldwide are integrating large language models and other generative tools into their operations. From AI-powered virtual assistants and personalized financial advisory to fraud detection and compliance automation, GenAI is driving innovation across functions. However, this transformation comes with significant cybersecurity and ethical risks. We discuss emerging threats such as AI-generated phishing, deepfake-enabled fraud, and adversarial attacks on AI systems, as well as concerns around bias, opacity, and data misuse. The evolving global regulatory landscape is explored in depth, including initiatives by major financial regulators and international efforts to develop risk-based AI governance. Finally, we propose best practices for secure and responsible adoption - including explainability techniques, adversarial testing, auditability, and human oversight. Drawing from academic literature, industry case studies, and policy frameworks, this chapter offers a perspective on how the financial sector can harness GenAI's transformative potential while navigating the complex risks it introduces.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research methodology isn't explicitly detailed in the provided content, but it's implied to involve a global survey, academic literature review, industry case studies, and policy framework analysis.

Key Results

- GenAI is being adopted across various financial sectors for enhancing customer engagement, automating workflows, and extracting insights from financial data.

- GenAI applications include AI-powered virtual assistants, personalized financial advisory, fraud detection, and compliance automation.

- Emerging threats such as AI-generated phishing, deepfake-enabled fraud, and adversarial attacks on AI systems are identified.

Significance

This research is important as it provides an overview of GenAI adoption in the financial sector, highlighting both opportunities and risks, and offers best practices for secure and responsible implementation.

Technical Contribution

The paper contributes by categorizing and discussing various GenAI applications and associated risks in the financial domain, proposing risk mitigation strategies.

Novelty

This work stands out by offering a comprehensive global perspective on GenAI in finance, covering opportunities, threats, and regulatory aspects, which is valuable for both academia and industry stakeholders.

Limitations

- The paper does not detail specific survey methodologies or sample sizes, limiting the generalizability of findings.

- It primarily focuses on existing applications and threats, without extensive exploration of future potential developments.

Future Work

- Further research could delve into the effectiveness of proposed best practices in real-world implementations.

- Investigating the long-term impacts of GenAI on employment and skill requirements within the financial sector.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisks and Opportunities of Open-Source Generative AI

Fabio Pizzati, Trevor Darrell, Adel Bibi et al.

Generative AI regulation can learn from social media regulation

Ruth Elisabeth Appel

Cyber Threats in Financial Transactions -- Addressing the Dual Challenge of AI and Quantum Computing

Ahmed M. Elmisery, Mirela Sertovic, Andrew Zayin et al.

No citations found for this paper.

Comments (0)