Authors

Summary

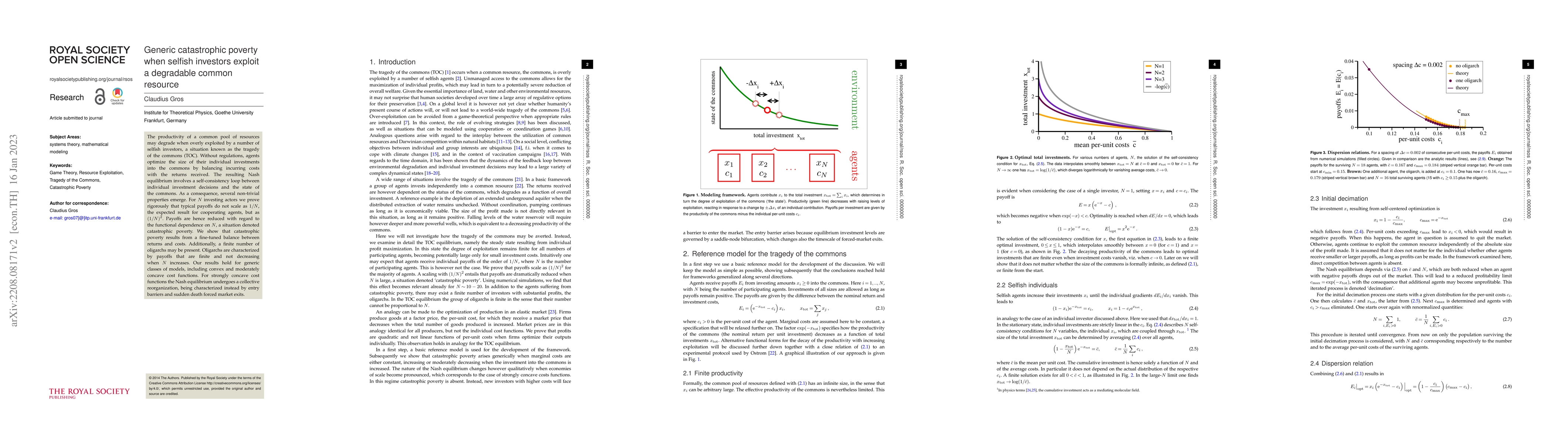

The productivity of a common pool of resources may degrade when overly exploited by a number of selfish investors, a situation known as the tragedy of the commons (TOC). Without regulations, agents optimize the size of their individual investments into the commons by balancing incurring costs with the returns received. The resulting Nash equilibrium involves a self-consistency loop between individual investment decisions and the state of the commons. As a consequence, several non-trivial properties emerge. For $N$ investing actors we prove rigorously that typical payoffs do not scale as $1/N$, the expected result for cooperating agents, but as $(1/N)^2$. Payoffs are hence reduced with regard to the functional dependence on $N$, a situation denoted catastrophic poverty. We show that catastrophic poverty results from a fine-tuned balance between returns and costs. Additionally, a finite number of oligarchs may be present. Oligarchs are characterized by payoffs that are finite and not decreasing when $N$ increases. Our results hold for generic classes of models, including convex and moderately concave cost functions. For strongly concave cost functions the Nash equilibrium undergoes a collective reorganization, being characterized instead by entry barriers and sudden death forced market exits.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)