Summary

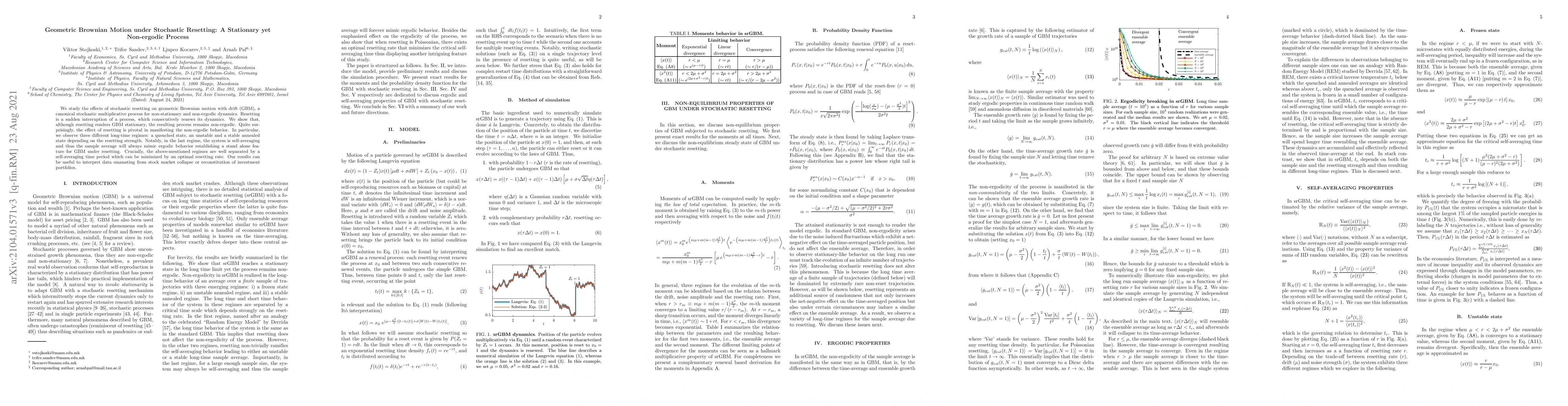

We study the effects of stochastic resetting on geometric Brownian motion (GBM), a canonical stochastic multiplicative process for non-stationary and non-ergodic dynamics. Resetting is a sudden interruption of a process, which consecutively renews its dynamics. We show that, although resetting renders GBM stationary, the resulting process remains non-ergodic. Quite surprisingly, the effect of resetting is pivotal in manifesting the non-ergodic behavior. In particular, we observe three different long-time regimes: a quenched state, an unstable and a stable annealed state depending on the resetting strength. Notably, in the last regime, the system is self-averaging and thus the sample average will always mimic ergodic behavior establishing a stand alone feature for GBM under resetting. Crucially, the above-mentioned regimes are well separated by a self-averaging time period which can be minimized by an optimal resetting rate. Our results can be useful to interpret data emanating from stock market collapse or reconstitution of investment portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersErgodic properties of Brownian motion under stochastic resetting

Eli Barkai, Vicenç Méndez, Rosa Flaquer-Galmes

The impact of stochastic resetting on resource allocation: The case of Reallocating geometric Brownian motion

Arnab Pal, Viktor Stojkoski, Trifce Sandev et al.

Active Brownian particle under stochastic orientational resetting

Thomas Franosch, Christina Kurzthaler, Yanis Baouche et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)