Summary

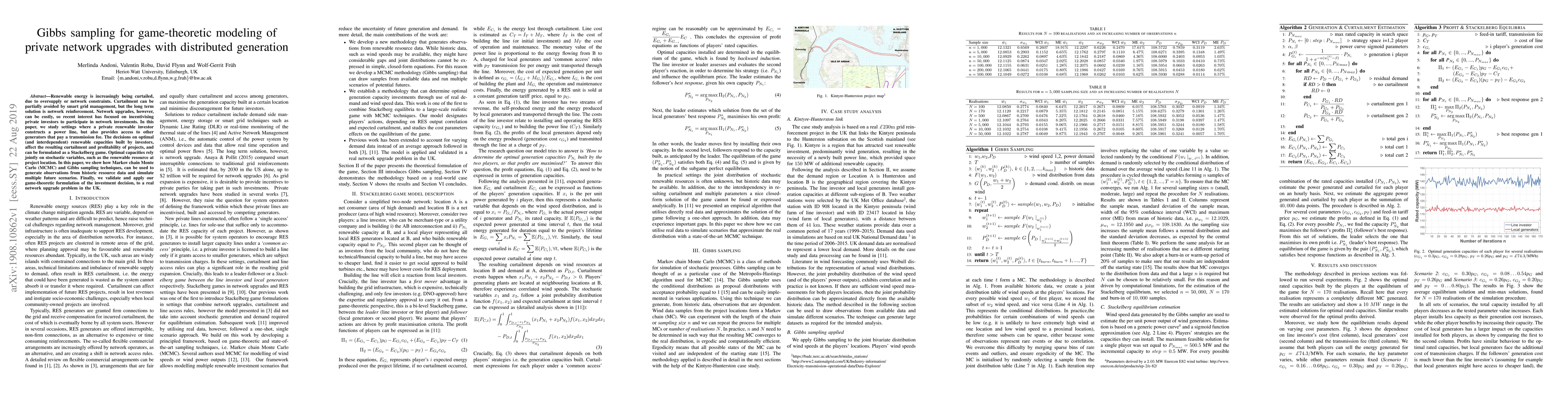

Renewable energy is increasingly being curtailed, due to oversupply or network constraints. Curtailment can be partially avoided by smart grid management, but the long term solution is network reinforcement. Network upgrades, however, can be costly, so recent interest has focused on incentivising private investors to participate in network investments. In this paper, we study settings where a private renewable investor constructs a power line, but also provides access to other generators that pay a transmission fee. The decisions on optimal (and interdependent) renewable capacities built by investors, affect the resulting curtailment and profitability of projects, and can be formulated as a Stackelberg game. Optimal capacities rely jointly on stochastic variables, such as the renewable resource at project location. In this paper, we show how Markov chain Monte Carlo (MCMC) and Gibbs sampling techniques, can be used to generate observations from historic resource data and simulate multiple future scenarios. Finally, we validate and apply our game-theoretic formulation of the investment decision, to a real network upgrade problem in the UK.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributed Machine Learning with Strategic Network Design: A Game-Theoretic Perspective

Tao Li, Quanyan Zhu, Shutian Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)