Authors

Summary

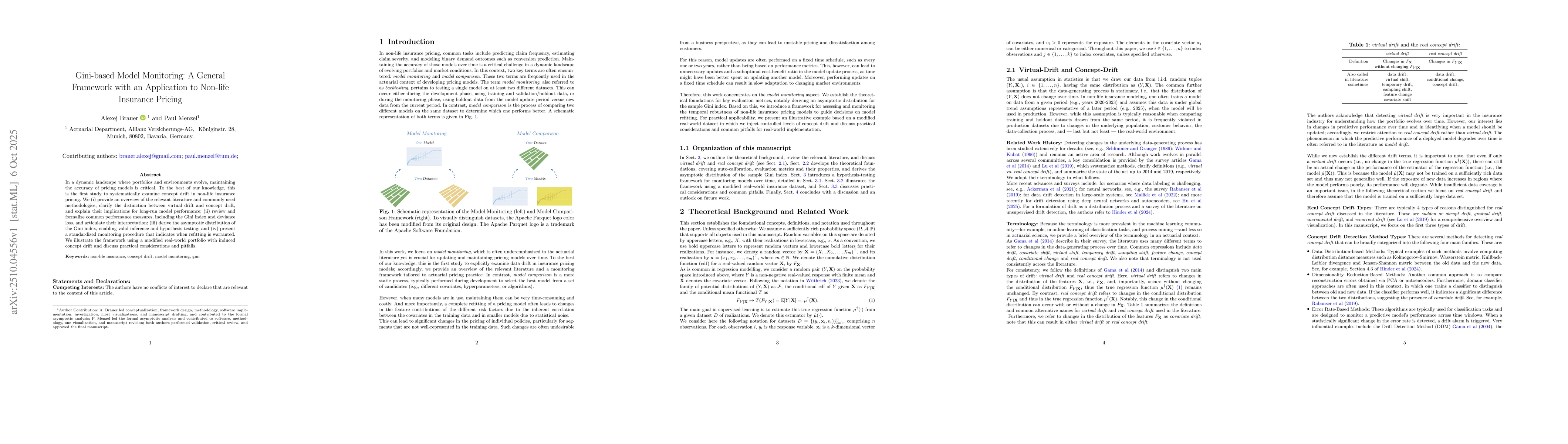

In a dynamic landscape where portfolios and environments evolve, maintaining the accuracy of pricing models is critical. To the best of our knowledge, this is the first study to systematically examine concept drift in non-life insurance pricing. We (i) provide an overview of the relevant literature and commonly used methodologies, clarify the distinction between virtual drift and concept drift, and explain their implications for long-run model performance; (ii) review and formalize common performance measures, including the Gini index and deviance loss, and articulate their interpretation; (iii) derive the asymptotic distribution of the Gini index, enabling valid inference and hypothesis testing; and (iv) present a standardized monitoring procedure that indicates when refitting is warranted. We illustrate the framework using a modified real-world portfolio with induced concept drift and discuss practical considerations and pitfalls.

AI Key Findings

Generated Oct 07, 2025

Methodology

The research employs a combination of theoretical analysis and empirical validation, focusing on the asymptotic normality of the Gini index under auto-calibration assumptions. It leverages functional analysis and empirical process theory to derive the asymptotic distribution of the Gini index.

Key Results

- The Gini index is shown to be asymptotically normal under the auto-calibration assumption, with a derived variance formula.

- The proof involves representing the Gini index as a statistical functional and applying the Hadamard differentiability and Delta Method.

- The results provide a theoretical foundation for using the Gini index in econometric and statistical modeling contexts.

Significance

This research advances the understanding of inequality measurement by establishing the asymptotic properties of the Gini index under auto-calibration. It enables more reliable statistical inference in applications involving income or wealth distribution analysis.

Technical Contribution

The paper provides a rigorous proof of the asymptotic normality of the Gini index under auto-calibration, establishing it as a statistically valid measure for inequality analysis.

Novelty

This work introduces a novel functional representation of the Gini index and applies advanced empirical process theory to derive its asymptotic distribution, distinguishing it from previous approaches that focused on computational properties rather than theoretical guarantees.

Limitations

- The analysis assumes continuous and finite distributions for both the outcome and the estimator, which may not hold in all practical scenarios.

- The theoretical results are derived for i.i.d. data, which may limit applicability to dependent or panel data structures.

Future Work

- Extending the analysis to non-i.i.d. settings such as time series or clustered data.

- Investigating the finite-sample performance of the Gini index through simulation studies.

- Exploring the application of these results to other inequality measures or concentration indices.

Comments (0)