Summary

The purpose of this paper is to explore the necessary conditions for optimality of mean-field forward-backward delay control systems. A new estimate is proved, which is a powerfultool to deal with the optimal control problems of mean-field type with delay. Different from the classical situation, in our case the first-order adjoint system is an anticipated mean-field backward stochastic differential equation, and the second-order adjoint system is a system of matrix-valued process, not mean-field type.With the help of two adjoint systems, the second-order expansion of the variation of the state $Y$ is proved, and therewith the Peng's stochastic maximum principle. As an illustrative example, we apply our result to the mean-field game in Finance. Although we just investigate the case of one pointwise delay for convenience, but our method is adequate for analysing the case of pointwise delay.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

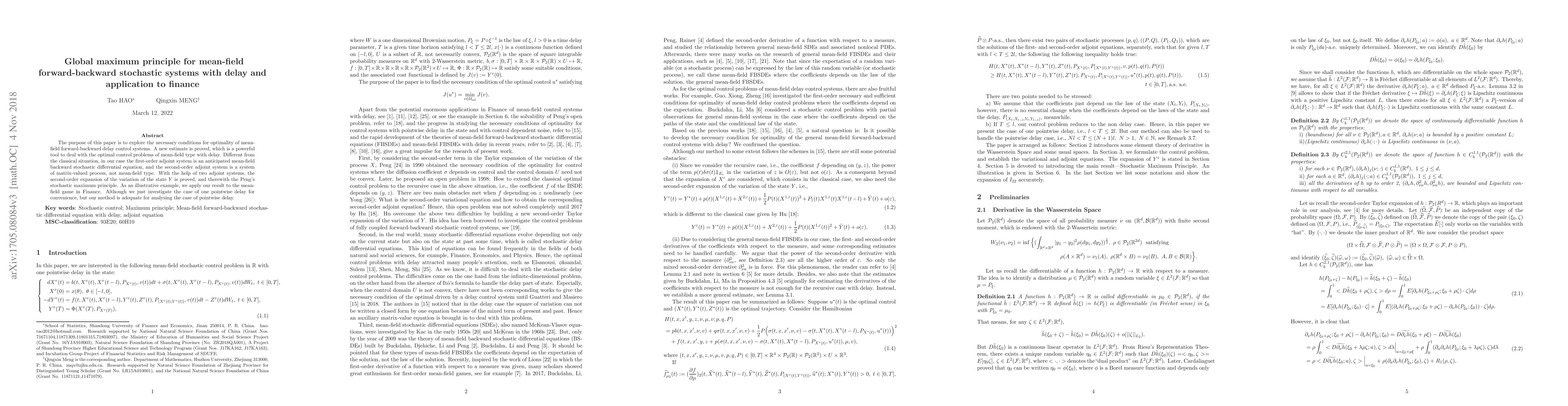

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Global Stochastic Maximum Principle for Mean-Field Forward-Backward Stochastic Control Systems with Quadratic Generators

Yanwei Li, Yi Wang, Juan Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)