Summary

We study robust notions of good-deal hedging and valuation under combined uncertainty about the drifts and volatilities of asset prices. Good-deal bounds are determined by a subset of risk-neutral pricing measures such that not only opportunities for arbitrage are excluded but also deals that are too good, by restricting instantaneous Sharpe ratios. A non-dominated multiple priors approach to model uncertainty (ambiguity) leads to worst-case good-deal bounds. Corresponding hedging strategies arise as minimizers of a suitable coherent risk measure. Good-deal bounds and hedges for measurable claims are characterized by solutions to second-order backward stochastic differential equations whose generators are non-convex in the volatility. These hedging strategies are robust with respect to uncertainty in the sense that their tracking errors satisfy a supermartingale property under all a-priori valuation measures, uniformly over all priors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

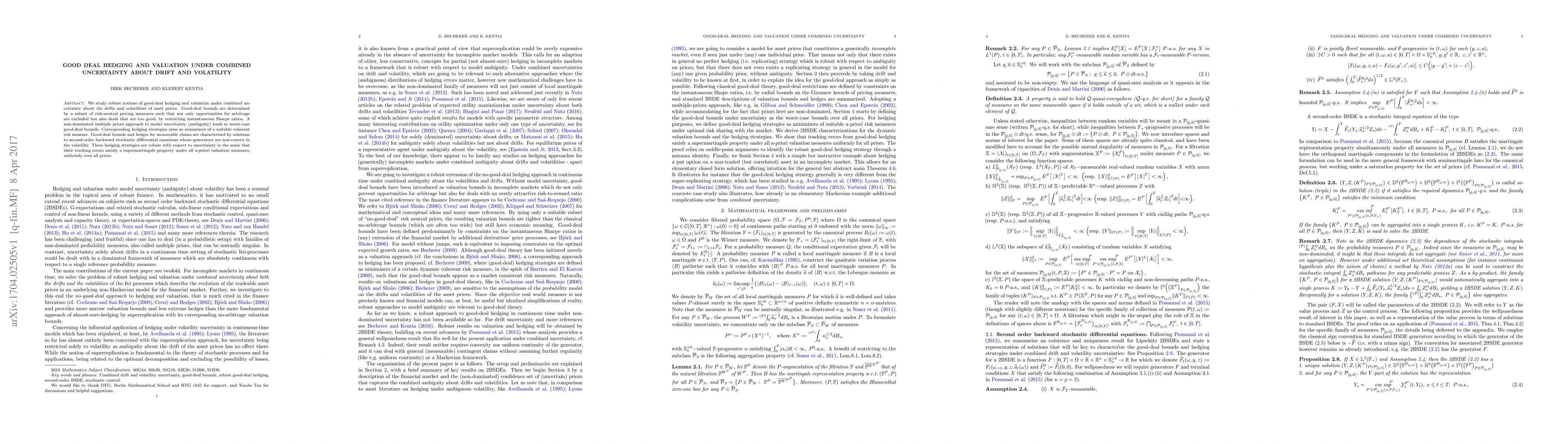

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)