Authors

Summary

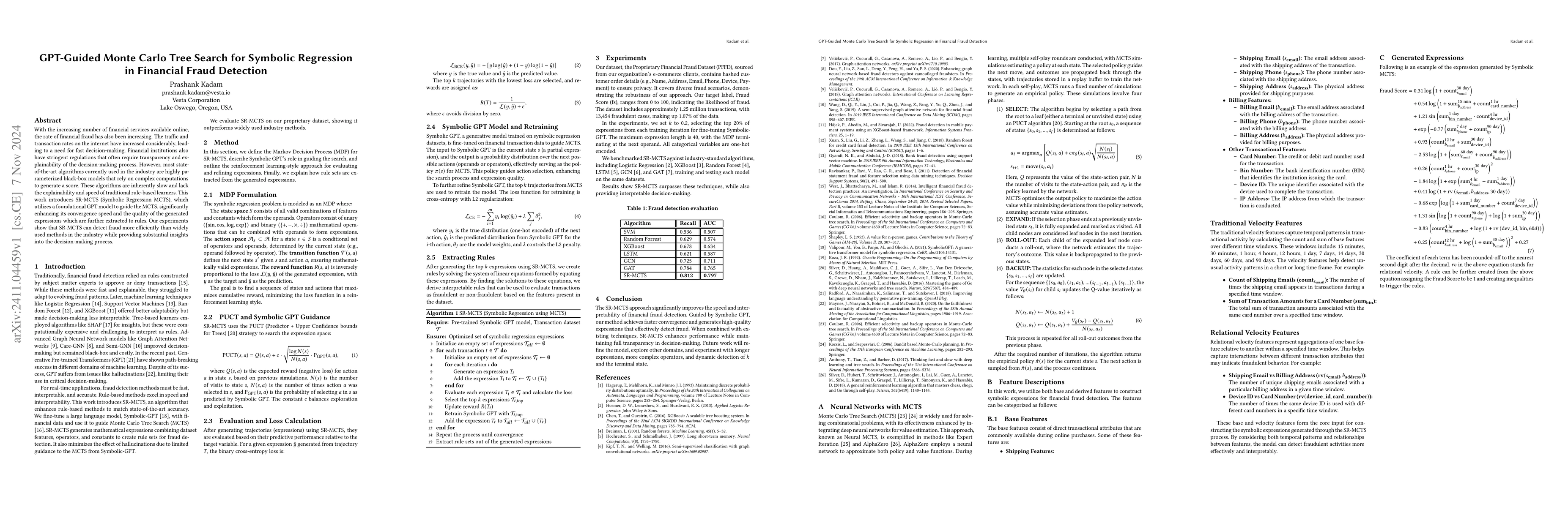

With the increasing number of financial services available online, the rate of financial fraud has also been increasing. The traffic and transaction rates on the internet have increased considerably, leading to a need for fast decision-making. Financial institutions also have stringent regulations that often require transparency and explainability of the decision-making process. However, most state-of-the-art algorithms currently used in the industry are highly parameterized black-box models that rely on complex computations to generate a score. These algorithms are inherently slow and lack the explainability and speed of traditional rule-based learners. This work introduces SR-MCTS (Symbolic Regression MCTS), which utilizes a foundational GPT model to guide the MCTS, significantly enhancing its convergence speed and the quality of the generated expressions which are further extracted to rules. Our experiments show that SR-MCTS can detect fraud more efficiently than widely used methods in the industry while providing substantial insights into the decision-making process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproving Monte Carlo Tree Search for Symbolic Regression

Daniel Zhengyu Huang, Hao Shi, Zhenyu Ming et al.

Discovering Mathematical Formulas from Data via GPT-guided Monte Carlo Tree Search

Min Wu, Shu Wei, Weijun Li et al.

Deep Generative Symbolic Regression with Monte-Carlo-Tree-Search

Pierre-Alexandre Kamienny, Sylvain Lamprier, Guillaume Lample et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)