Summary

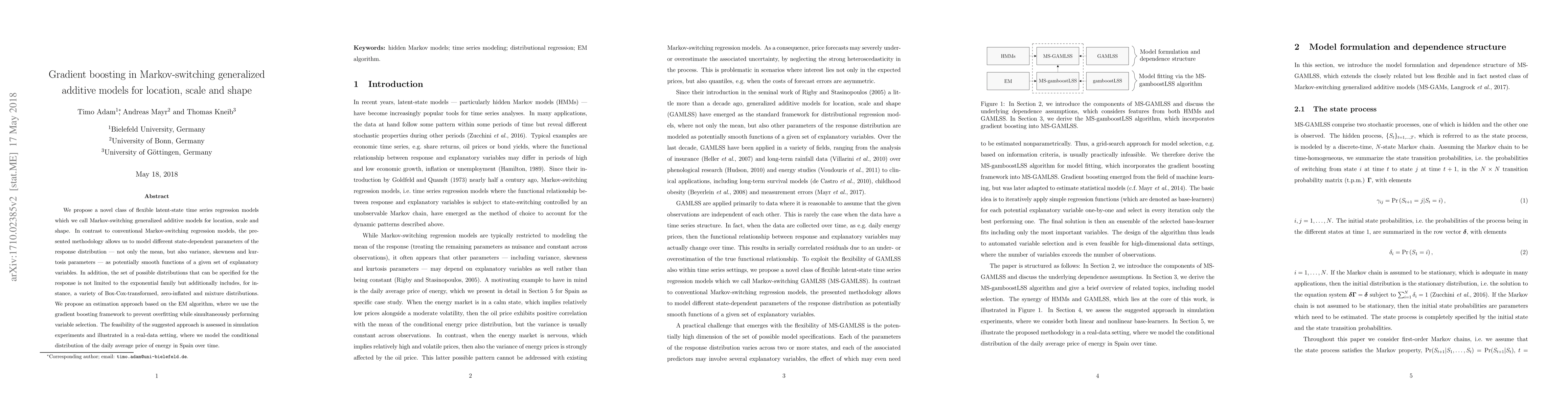

We propose a novel class of flexible latent-state time series regression models which we call Markov-switching generalized additive models for location, scale and shape. In contrast to conventional Markov-switching regression models, the presented methodology allows us to model different state-dependent parameters of the response distribution - not only the mean, but also variance, skewness and kurtosis parameters - as potentially smooth functions of a given set of explanatory variables. In addition, the set of possible distributions that can be specified for the response is not limited to the exponential family but additionally includes, for instance, a variety of Box-Cox-transformed, zero-inflated and mixture distributions. We propose an estimation approach based on the EM algorithm, where we use the gradient boosting framework to prevent overfitting while simultaneously performing variable selection. The feasibility of the suggested approach is assessed in simulation experiments and illustrated in a real-data setting, where we model the conditional distribution of the daily average price of energy in Spain over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)