Summary

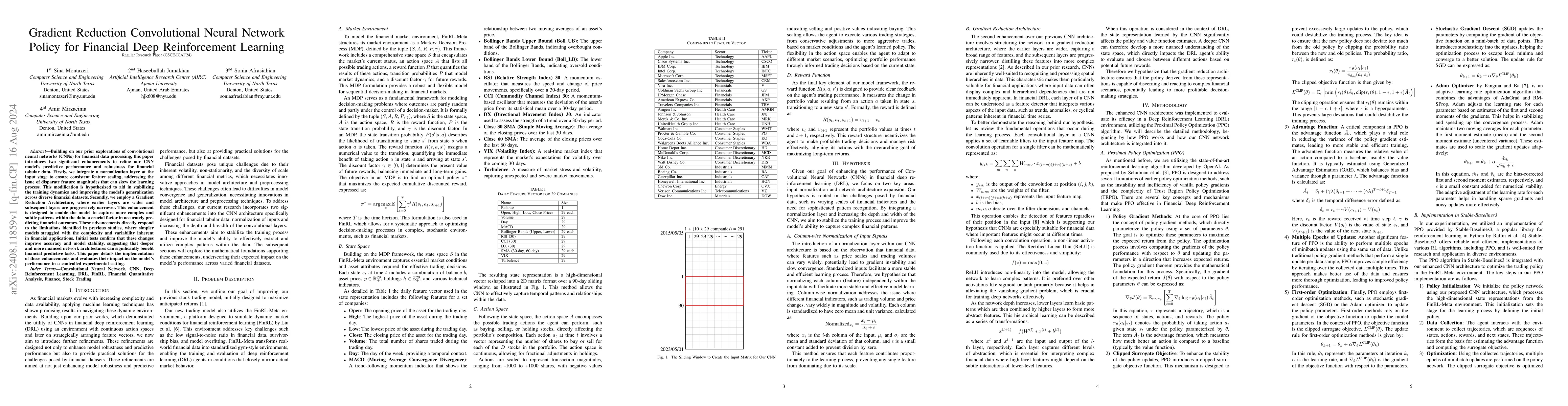

Building on our prior explorations of convolutional neural networks (CNNs) for financial data processing, this paper introduces two significant enhancements to refine our CNN model's predictive performance and robustness for financial tabular data. Firstly, we integrate a normalization layer at the input stage to ensure consistent feature scaling, addressing the issue of disparate feature magnitudes that can skew the learning process. This modification is hypothesized to aid in stabilizing the training dynamics and improving the model's generalization across diverse financial datasets. Secondly, we employ a Gradient Reduction Architecture, where earlier layers are wider and subsequent layers are progressively narrower. This enhancement is designed to enable the model to capture more complex and subtle patterns within the data, a crucial factor in accurately predicting financial outcomes. These advancements directly respond to the limitations identified in previous studies, where simpler models struggled with the complexity and variability inherent in financial applications. Initial tests confirm that these changes improve accuracy and model stability, suggesting that deeper and more nuanced network architectures can significantly benefit financial predictive tasks. This paper details the implementation of these enhancements and evaluates their impact on the model's performance in a controlled experimental setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLatent-Conditioned Policy Gradient for Multi-Objective Deep Reinforcement Learning

Chetan Gupta, Takuya Kanazawa

Distributed Policy Gradient with Variance Reduction in Multi-Agent Reinforcement Learning

Li Li, Jie Chen, Jinlong Lei et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)