Summary

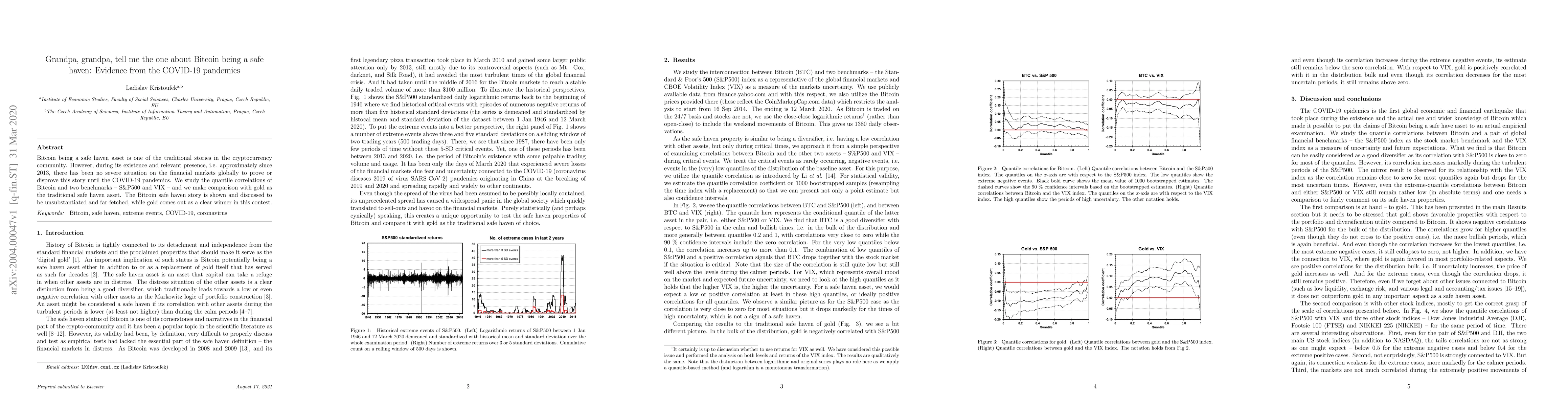

Bitcoin being a safe haven asset is one of the traditional stories in the cryptocurrency community. However, during its existence and relevant presence, i.e. approximately since 2013, there has been no severe situation on the financial markets globally to prove or disprove this story until the COVID-19 pandemics. We study the quantile correlations of Bitcoin and two benchmarks -- S\&P500 and VIX -- and we make comparison with gold as the traditional safe haven asset. The Bitcoin safe haven story is shown and discussed to be unsubstantiated and far-fetched, while gold comes out as a clear winner in this contest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCrypto-assets better safe-havens than Gold during Covid-19: The case of European indices

Alhonita Yatie

GRANDPA: GeneRAtive Network sampling using Degree and Property Augmentation applied to the analysis of partially confidential healthcare networks

Yifan Zhao, Carly A. Bobak, Joshua J. Levy et al.

Pandemics are catalysts of scientific novelty: Evidence from COVID-19

Jian Xu, Ying Ding, Mujeen Sung et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)