Authors

Summary

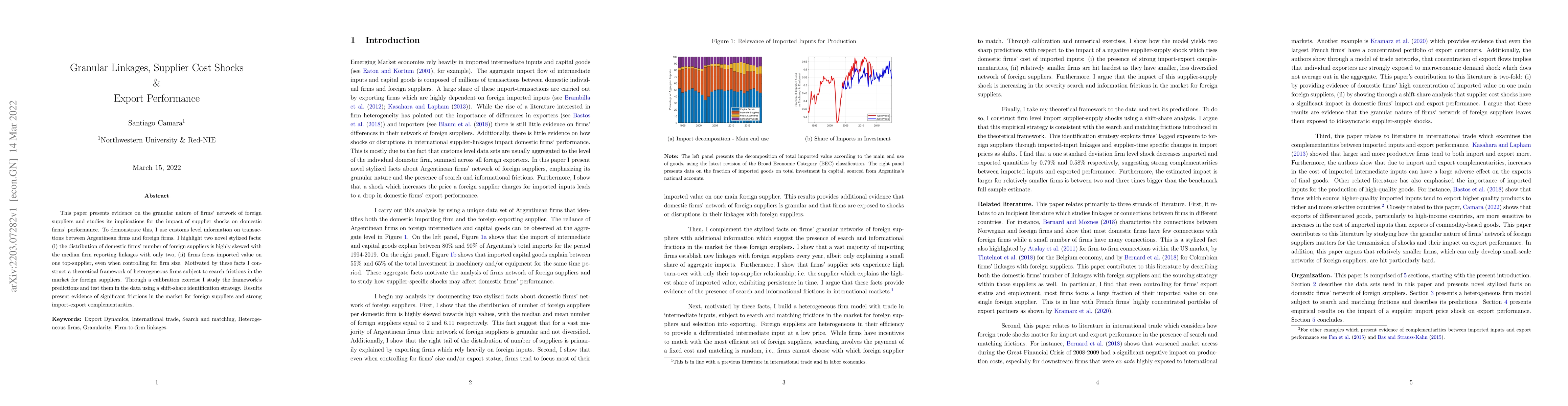

This paper presents evidence on the granular nature of firms' network of foreign suppliers and studies its implications for the impact of supplier shocks on domestic firms' performance. To demonstrate this, I use customs level information on transactions between Argentinean firms and foreign firms. I highlight two novel stylized facts: (i) the distribution of domestic firms' number of foreign suppliers is highly skewed with the median firm reporting linkages with only two, (ii) firms focus imported value on one top-supplier, even when controlling for firm size. Motivated by these facts I construct a theoretical framework of heterogeneous firms subject to search frictions in the market for foreign suppliers. Through a calibration exercise I study the framework's predictions and test them in the data using a shift-share identification strategy. Results present evidence of significant frictions in the market for foreign suppliers and strong import-export complementarities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)