Summary

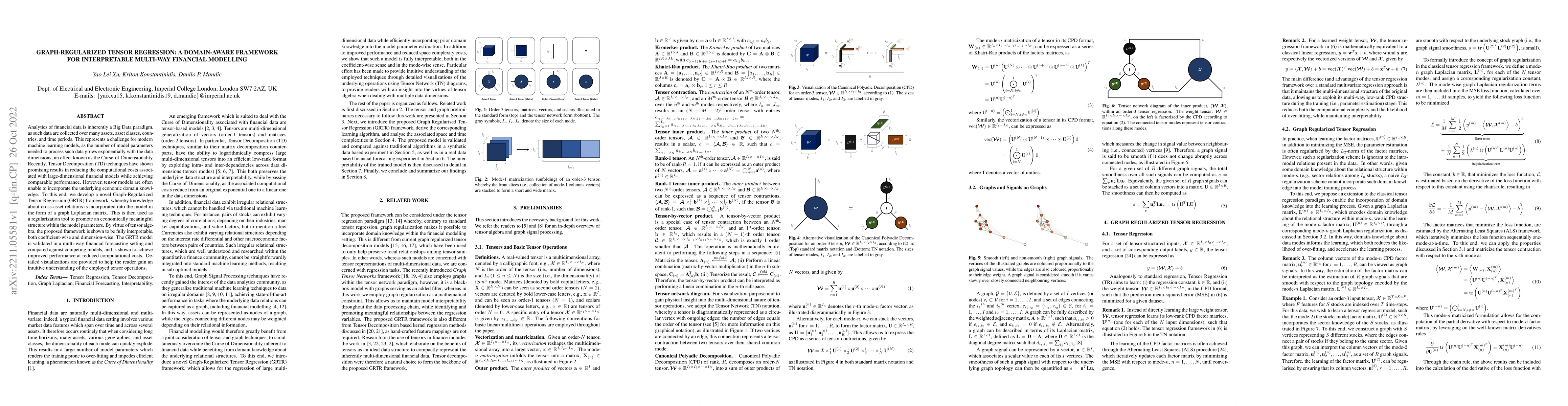

Analytics of financial data is inherently a Big Data paradigm, as such data are collected over many assets, asset classes, countries, and time periods. This represents a challenge for modern machine learning models, as the number of model parameters needed to process such data grows exponentially with the data dimensions; an effect known as the Curse-of-Dimensionality. Recently, Tensor Decomposition (TD) techniques have shown promising results in reducing the computational costs associated with large-dimensional financial models while achieving comparable performance. However, tensor models are often unable to incorporate the underlying economic domain knowledge. To this end, we develop a novel Graph-Regularized Tensor Regression (GRTR) framework, whereby knowledge about cross-asset relations is incorporated into the model in the form of a graph Laplacian matrix. This is then used as a regularization tool to promote an economically meaningful structure within the model parameters. By virtue of tensor algebra, the proposed framework is shown to be fully interpretable, both coefficient-wise and dimension-wise. The GRTR model is validated in a multi-way financial forecasting setting and compared against competing models, and is shown to achieve improved performance at reduced computational costs. Detailed visualizations are provided to help the reader gain an intuitive understanding of the employed tensor operations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)