Summary

We introduce U-shaped encoder-decoder graph neural networks (U-GNNs) for stochastic graph signal generation using denoising diffusion processes. The architecture learns node features at different resolutions with skip connections between the encoder and decoder paths, analogous to the convolutional U-Net for image generation. The U-GNN is prominent for a pooling operation that leverages zero-padding and avoids arbitrary graph coarsening, with graph convolutions layered on top to capture local dependencies. This technique permits learning feature embeddings for sampled nodes at deeper levels of the architecture that remain convolutional with respect to the original graph. Applied to stock price prediction -- where deterministic forecasts struggle to capture uncertainties and tail events that are paramount -- we demonstrate the effectiveness of the diffusion model in probabilistic forecasting of stock prices.

AI Key Findings

Generated Sep 30, 2025

Methodology

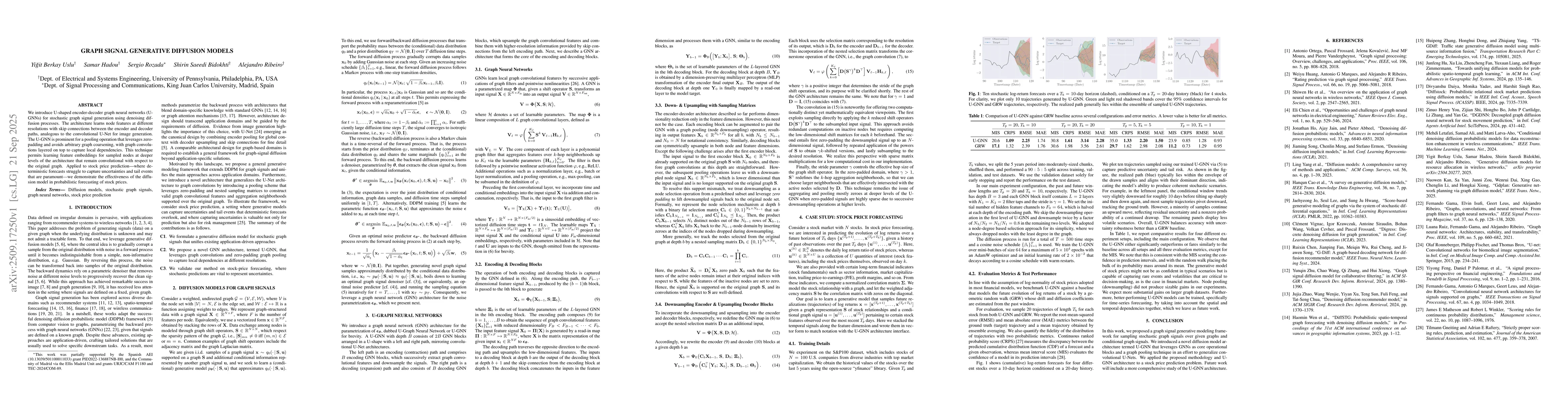

The research introduces U-shaped encoder-decoder graph neural networks (U-GNNs) for stochastic graph signal generation using denoising diffusion processes. The methodology involves training a diffusion model to reverse the noise addition process, utilizing graph neural networks with skip connections and pooling operations to capture local dependencies and maintain feature embeddings across different resolutions.

Key Results

- The U-GNN model effectively generates probabilistic forecasts of stock prices, capturing uncertainties and tail events that deterministic models fail to address.

- The model demonstrates competitive performance compared to baseline methods like GRW, with lower RMSE and MAE metrics across multiple configurations.

- The use of zero-padding and nested sampling matrices allows the model to maintain graph structure during downsampling and upsampling, preserving the original graph's properties.

Significance

This research is significant as it addresses the limitations of deterministic models in financial forecasting by introducing a probabilistic approach that captures market uncertainties and rare events, which are critical for decision-making in financial markets.

Technical Contribution

The technical contribution includes the development of a novel diffusion model architecture (U-GNN) that integrates graph neural networks with skip connections and nested sampling matrices, enabling effective feature learning and maintaining graph structure during the diffusion process.

Novelty

The novelty lies in the application of diffusion models to graph signal generation, specifically for stock price prediction, combined with a U-shaped GNN architecture that maintains graph structure through zero-padding and nested sampling matrices, differing from traditional graph pooling techniques.

Limitations

- Node pooling (downsampling) did not produce significant gains in the experiments, suggesting potential limitations in capturing fine-grained node interactions.

- The model's performance on larger graph datasets may require further optimization and validation.

Future Work

- Exploring more substantial gains on larger graph datasets to improve scalability.

- Training better-performing U-GNN models by incorporating spatial and temporal dependencies together for time-series forecasting.

- Conducting a more comprehensive study of the U-GNN architecture to refine its design and application.

Paper Details

PDF Preview

Similar Papers

Found 4 papersGraph-Aware Diffusion for Signal Generation

Antonio G. Marques, Sergio Rozada, Hadi Jamali-Rad et al.

Diffusion-based Graph Generative Methods

Qiang Zhang, Can Xu, Hongyang Chen et al.

Speech Signal Improvement Using Causal Generative Diffusion Models

Bunlong Lay, Timo Gerkmann, Julius Richter et al.

Comments (0)