Authors

Summary

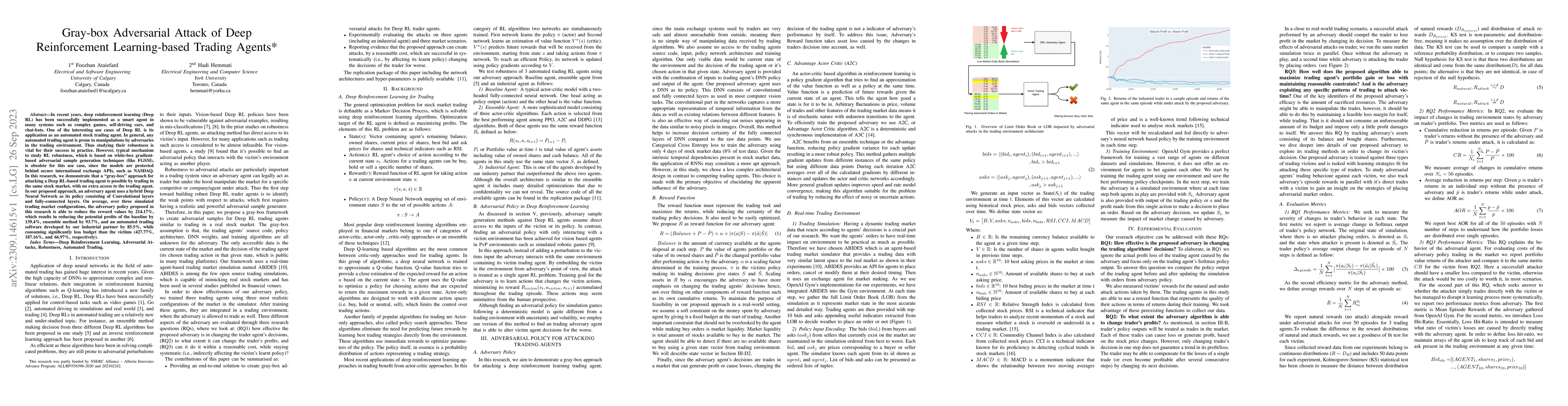

In recent years, deep reinforcement learning (Deep RL) has been successfully implemented as a smart agent in many systems such as complex games, self-driving cars, and chat-bots. One of the interesting use cases of Deep RL is its application as an automated stock trading agent. In general, any automated trading agent is prone to manipulations by adversaries in the trading environment. Thus studying their robustness is vital for their success in practice. However, typical mechanism to study RL robustness, which is based on white-box gradient-based adversarial sample generation techniques (like FGSM), is obsolete for this use case, since the models are protected behind secure international exchange APIs, such as NASDAQ. In this research, we demonstrate that a "gray-box" approach for attacking a Deep RL-based trading agent is possible by trading in the same stock market, with no extra access to the trading agent. In our proposed approach, an adversary agent uses a hybrid Deep Neural Network as its policy consisting of Convolutional layers and fully-connected layers. On average, over three simulated trading market configurations, the adversary policy proposed in this research is able to reduce the reward values by 214.17%, which results in reducing the potential profits of the baseline by 139.4%, ensemble method by 93.7%, and an automated trading software developed by our industrial partner by 85.5%, while consuming significantly less budget than the victims (427.77%, 187.16%, and 66.97%, respectively).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 5 papersGeneralizing and Unifying Gray-box Combinatorial Optimization Operators

Francisco Chicano, Darrell Whitley, Gabriela Ochoa et al.

Improving Hyperparameter Optimization with Checkpointed Model Weights

Jonathan Lorraine, Nikhil Mehta, Steve Masson et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)