Summary

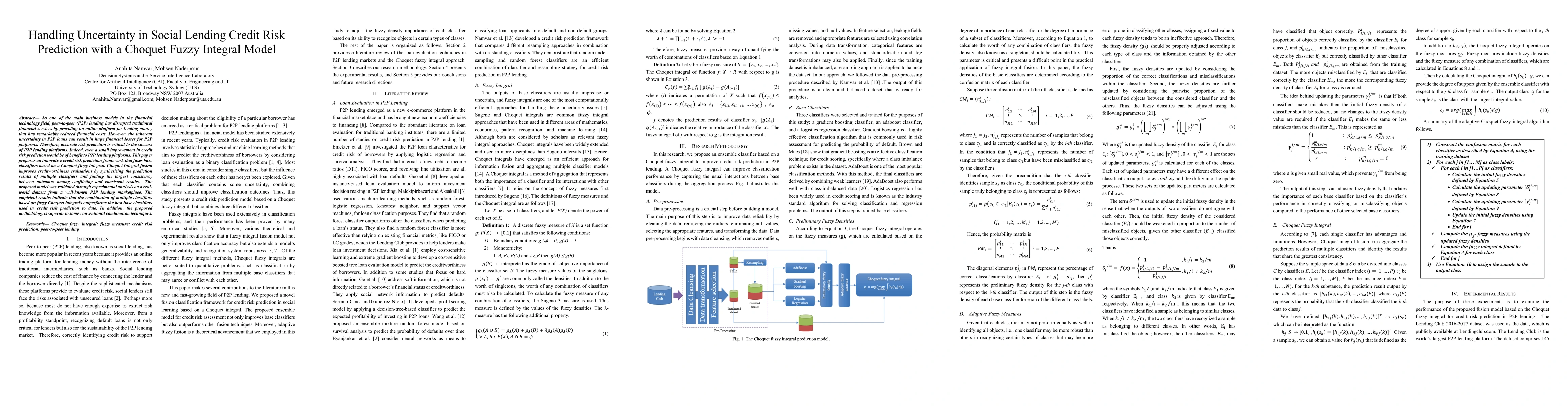

As one of the main business models in the financial technology field, peer-to-peer (P2P) lending has disrupted traditional financial services by providing an online platform for lending money that has remarkably reduced financial costs. However, the inherent uncertainty in P2P loans can result in huge financial losses for P2P platforms. Therefore, accurate risk prediction is critical to the success of P2P lending platforms. Indeed, even a small improvement in credit risk prediction would be of benefit to P2P lending platforms. This paper proposes an innovative credit risk prediction framework that fuses base classifiers based on a Choquet fuzzy integral. Choquet integral fusion improves creditworthiness evaluations by synthesizing the prediction results of multiple classifiers and finding the largest consistency between outcomes among conflicting and consistent results. The proposed model was validated through experimental analysis on a real- world dataset from a well-known P2P lending marketplace. The empirical results indicate that the combination of multiple classifiers based on fuzzy Choquet integrals outperforms the best base classifiers used in credit risk prediction to date. In addition, the proposed methodology is superior to some conventional combination techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)