Summary

The BMO martingale theory is extensively used to study nonlinear multi-dimensional stochastic equations (SEs) in $\cR^p$ ($p\in [1, \infty)$) and backward stochastic differential equations (BSDEs) in $\cR^p\times \cH^p$ ($p\in (1, \infty)$) and in $\cR^\infty\times \bar{\cH^\infty}^{BMO}$, with the coefficients being allowed to be unbounded. In particular, the probabilistic version of Fefferman's inequality plays a crucial role in the development of our theory, which seems to be new. Several new results are consequently obtained. The particular multi-dimensional linear case for SDEs and BSDEs are separately investigated, and the existence and uniqueness of a solution is connected to the property that the elementary solutions-matrix for the associated homogeneous SDE satisfies the reverse H\"older inequality for some suitable exponent $p\ge 1$. Finally, we establish some relations between Kazamaki's quadratic critical exponent $b(M)$ of a BMO martingale $M$ and the spectral radius of the solution operator for the $M$-driven SDE, which lead to a characterization of Kazamaki's quadratic critical exponent of BMO martingales being infinite.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

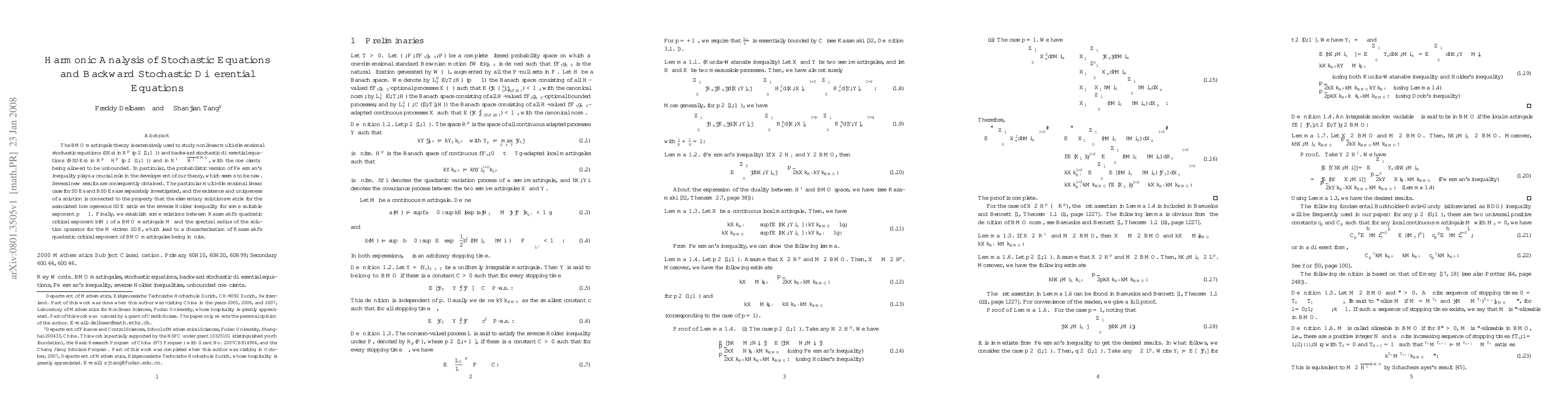

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)