Summary

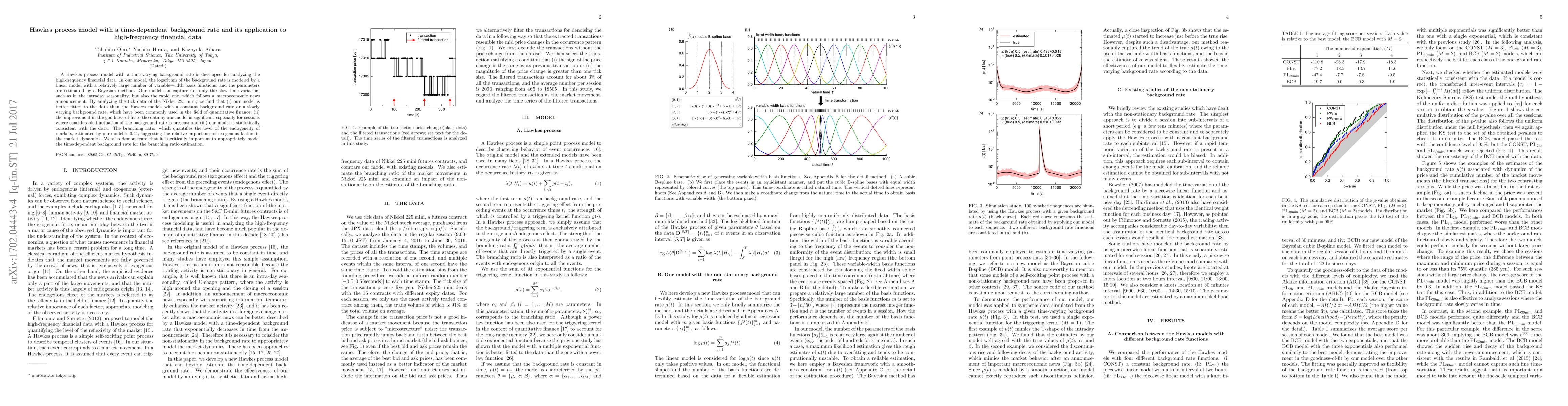

A Hawkes process model with a time-varying background rate is developed for analyzing the high-frequency financial data. In our model, the logarithm of the background rate is modeled by a linear model with a relatively large number of variable-width basis functions, and the parameters are estimated by a Bayesian method. Our model can capture not only the slow time-variation, such as in the intraday seasonality, but also the rapid one, which follows a macroeconomic news announcement. By analyzing the tick data of the Nikkei 225 mini, we find that (i) our model is better fitted to the data than the Hawkes models with a constant background rate or a slowly varying background rate, which have been commonly used in the field of quantitative finance; (ii) the improvement in the goodness-of-fit to the data by our model is significant especially for sessions where considerable fluctuation of the background rate is present; and (iii) our model is statistically consistent with the data. The branching ratio, which quantifies the level of the endogeneity of markets, estimated by our model is 0.41, suggesting the relative importance of exogenous factors in the market dynamics. We also demonstrate that it is critically important to appropriately model the time-dependent background rate for the branching ratio estimation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVariance-Hawkes Process and its Application to Energy Markets

Anatoliy Swishchuk, Joshua McGillivray

| Title | Authors | Year | Actions |

|---|

Comments (0)