Authors

Summary

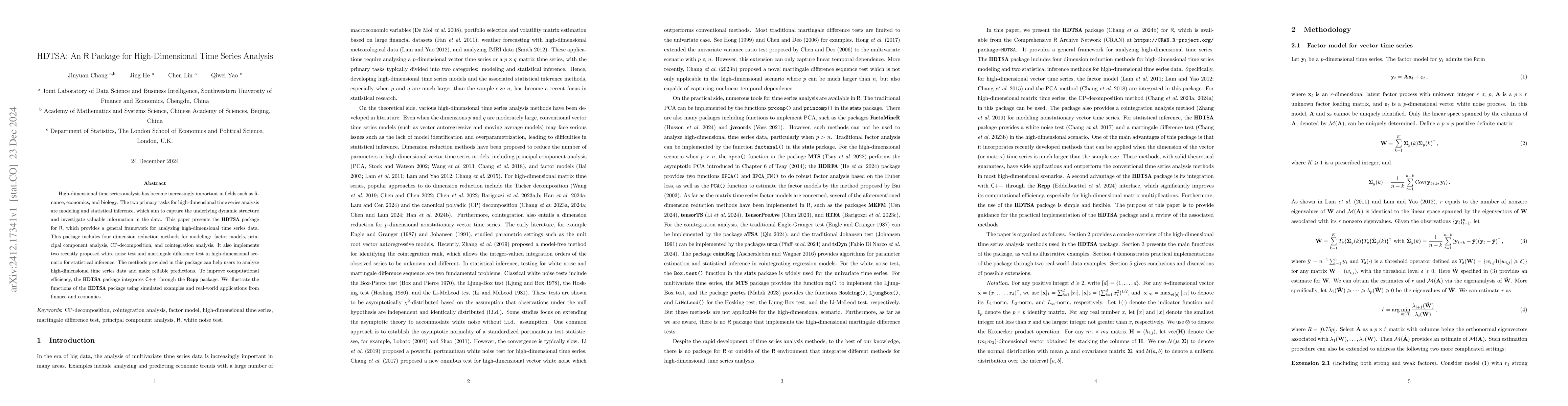

High-dimensional time series analysis has become increasingly important in fields such as finance, economics, and biology. The two primary tasks for high-dimensional time series analysis are modeling and statistical inference, which aim to capture the underlying dynamic structure and investigate valuable information in the data. This paper presents the HDTSA package for R, which provides a general framework for analyzing high-dimensional time series data. This package includes four dimension reduction methods for modeling: factor models, principal component analysis, CP-decomposition, and cointegration analysis. It also implements two recently proposed white noise test and martingale difference test in high-dimensional scenario for statistical inference. The methods provided in this package can help users to analyze high-dimensional time series data and make reliable predictions. To improve computational efficiency, the HDTSA package integrates C++ through the Rcpp package. We illustrate the functions of the HDTSA package using simulated examples and real-world applications from finance and economics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 paperswavScalogram: an R package with wavelet scalogram tools for time series analysis

Vicente J. Bolos, Rafael Benitez

Ordinal time series analysis with the R package otsfeatures

José Antonio Vilar Fernández, Ángel López Oriona

No citations found for this paper.

Comments (0)