Authors

Summary

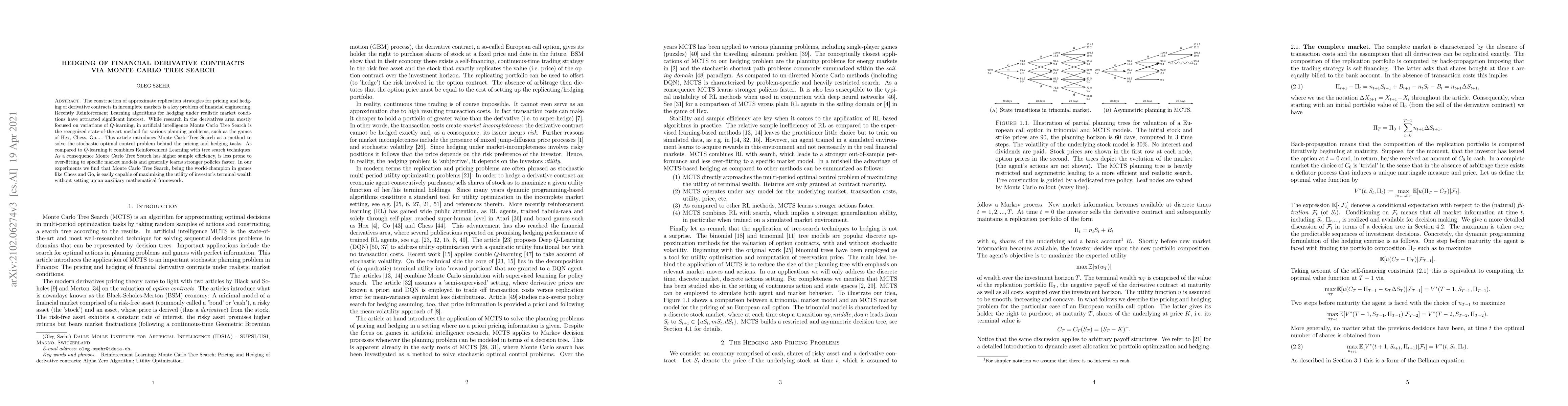

The construction of approximate replication strategies for pricing and hedging of derivative contracts in incomplete markets is a key problem of financial engineering. Recently Reinforcement Learning algorithms for hedging under realistic market conditions have attracted significant interest. While research in the derivatives area mostly focused on variations of $Q$-learning, in artificial intelligence Monte Carlo Tree Search is the recognized state-of-the-art method for various planning problems, such as the games of Hex, Chess, Go,... This article introduces Monte Carlo Tree Search as a method to solve the stochastic optimal control problem behind the pricing and hedging tasks. As compared to $Q$-learning it combines Reinforcement Learning with tree search techniques. As a consequence Monte Carlo Tree Search has higher sample efficiency, is less prone to over-fitting to specific market models and generally learns stronger policies faster. In our experiments we find that Monte Carlo Tree Search, being the world-champion in games like Chess and Go, is easily capable of maximizing the utility of investor's terminal wealth without setting up an auxiliary mathematical framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonte Carlo Search Algorithms Discovering Monte Carlo Tree Search Exploration Terms

Tristan Cazenave

Solving Multi-Period Financial Planning Models: Combining Monte Carlo Tree Search and Neural Networks

Xiaoyue Li, John M. Mulvey, Afşar Onat Aydınhan

| Title | Authors | Year | Actions |

|---|

Comments (0)