Summary

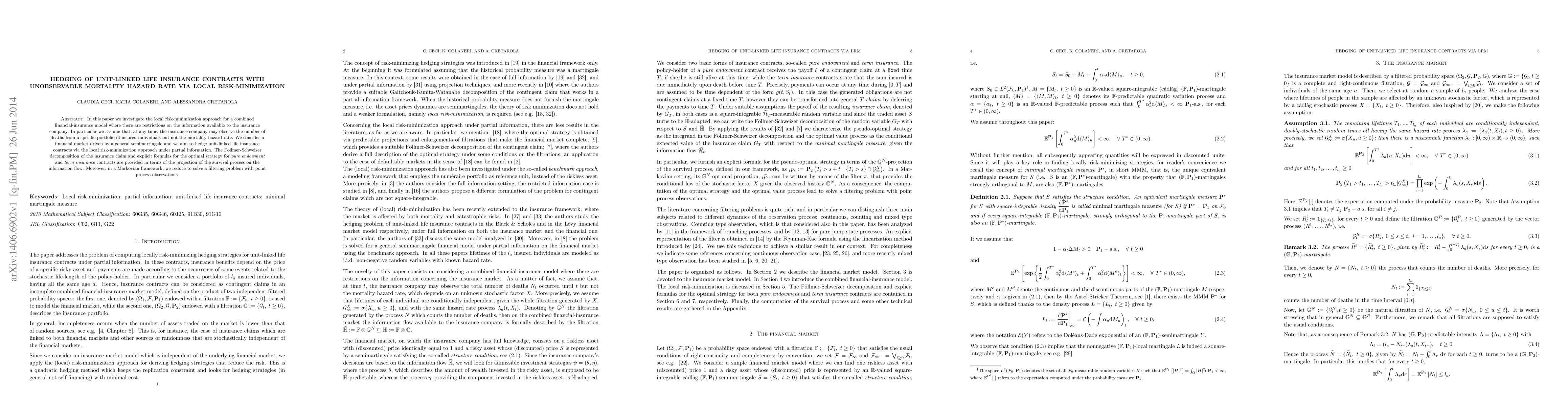

In this paper we investigate the local risk-minimization approach for a combined financial-insurance model where there are restrictions on the information available to the insurance company. In particular we assume that, at any time, the insurance company may observe the number of deaths from a specific portfolio of insured individuals but not the mortality hazard rate. We consider a financial market driven by a general semimartingale and we aim to hedge unit-linked life insurance contracts via the local risk-minimization approach under partial information. The F\"ollmer-Schweizer decomposition of the insurance claim and explicit formulas for the optimal strategy for pure endowment and term insurance contracts are provided in terms of the projection of the survival process on the information flow. Moreover, in a Markovian framework, we reduce to solve a filtering problem with point process observations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)