Summary

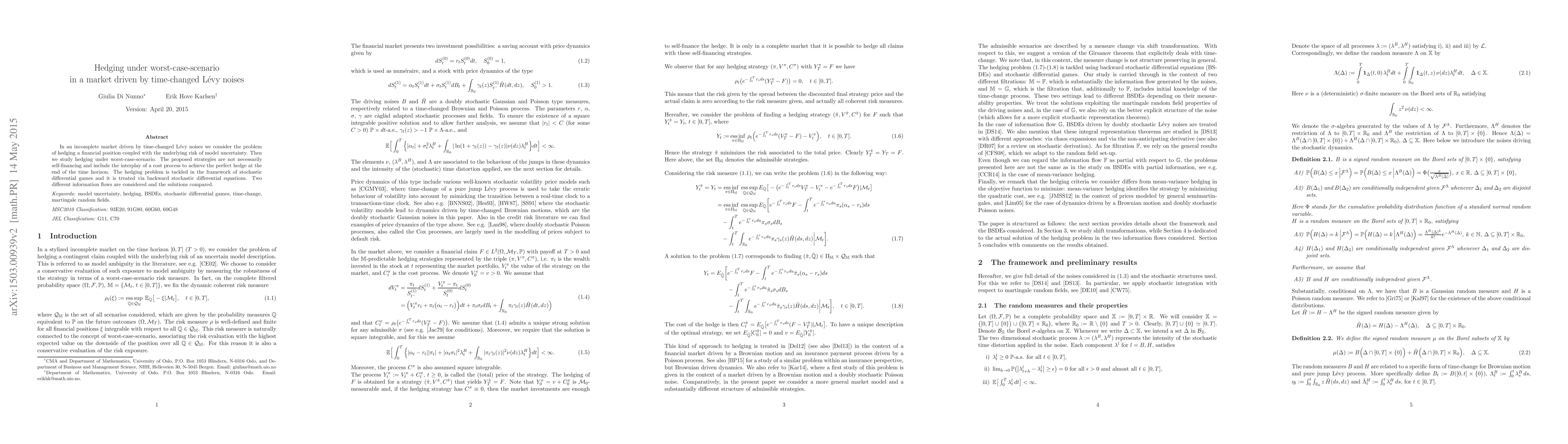

In an incomplete market driven by time-changed L\'evy noises we consider the problem of hedging a financial position coupled with the underlying risk of model uncertainty. Then we study hedging under worst-case-scenario. The proposed strategies are not necessarily self-financing and include the interplay of a cost process to achieve the perfect hedge at the end of the time horizon. The hedging problem is tackled in the framework of stochastic differential games and it is treated via backward stochastic differential equations. Two different information flows are considered and the solutions compared.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)