Summary

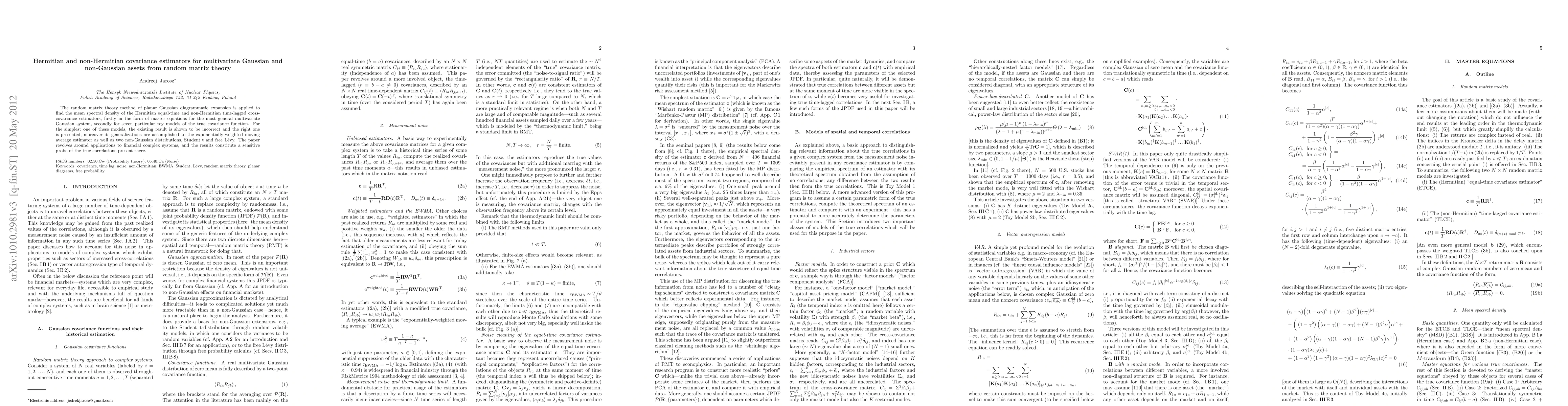

The random matrix theory method of planar Gaussian diagrammatic expansion is applied to find the mean spectral density of the Hermitian equal-time and non-Hermitian time-lagged cross-covariance estimators, firstly in the form of master equations for the most general multivariate Gaussian system, secondly for seven particular toy models of the true covariance function. For the simplest one of these models, the existing result is shown to be incorrect and the right one is presented, moreover its generalizations are accomplished to the exponentially-weighted moving average estimator as well as two non-Gaussian distributions, Student t and free Levy. The paper revolves around applications to financial complex systems, and the results constitute a sensitive probe of the true correlations present there.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)