Summary

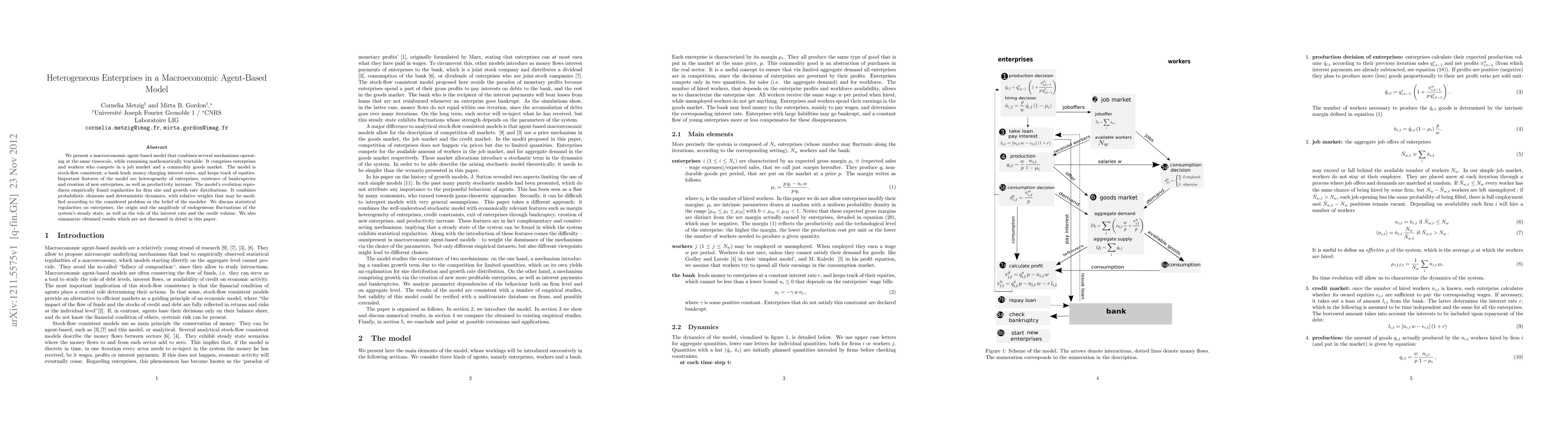

We present a macroeconomic agent-based model that combines several mechanisms operating at the same timescale, while remaining mathematically tractable. It comprises enterprises and workers who compete in a job market and a commodity goods market. The model is stock-flow consistent; a bank lends money charging interest rates, and keeps track of equities. Important features of the model are heterogeneity of enterprises, existence of bankruptcies and creation of new enterprises, as well as productivity increase. The model's evolution reproduces empirically found regularities for firm size and growth rate distributions. It combines probabilistic elements and deterministic dynamics, with relative weights that may be modified according to the considered problem or the belief of the modeler. We discuss statistical regularities on enterprises, the origin and the amplitude of endogeneous fluctuations of the system's steady state, as well as the role of the interest rate and the credit volume. We also summarize obtained results which are not discussed in detail in this paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinding Regularized Competitive Equilibria of Heterogeneous Agent Macroeconomic Models with Reinforcement Learning

Tianhao Wang, Michael I. Jordan, Zhuoran Yang et al.

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Adelinde Uhrmacher, Florian Peters, Doris Neuberger et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)