Authors

Summary

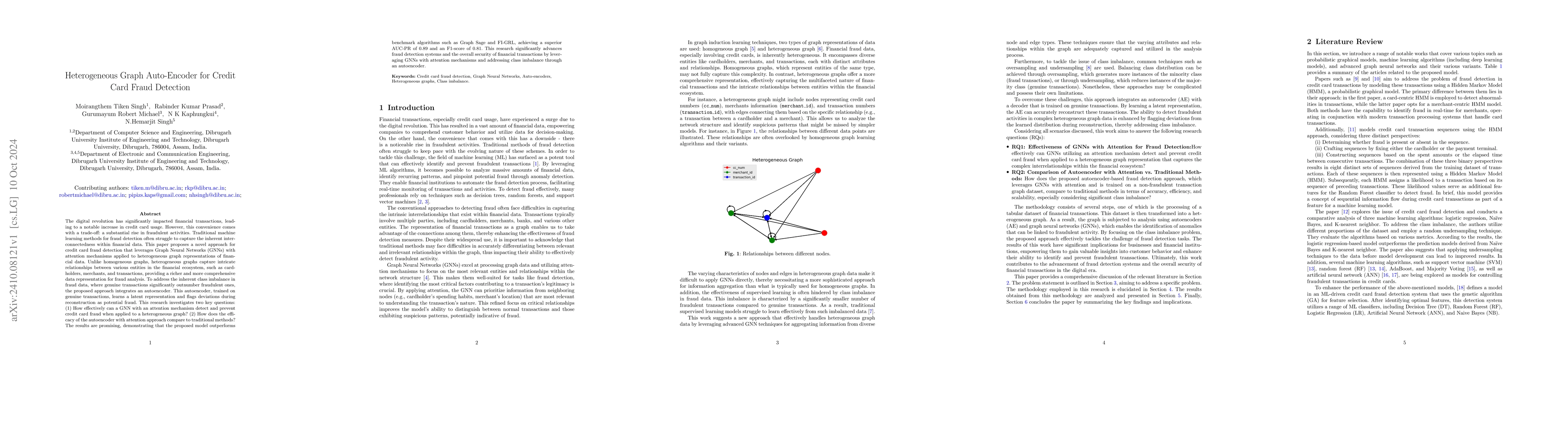

The digital revolution has significantly impacted financial transactions, leading to a notable increase in credit card usage. However, this convenience comes with a trade-off: a substantial rise in fraudulent activities. Traditional machine learning methods for fraud detection often struggle to capture the inherent interconnectedness within financial data. This paper proposes a novel approach for credit card fraud detection that leverages Graph Neural Networks (GNNs) with attention mechanisms applied to heterogeneous graph representations of financial data. Unlike homogeneous graphs, heterogeneous graphs capture intricate relationships between various entities in the financial ecosystem, such as cardholders, merchants, and transactions, providing a richer and more comprehensive data representation for fraud analysis. To address the inherent class imbalance in fraud data, where genuine transactions significantly outnumber fraudulent ones, the proposed approach integrates an autoencoder. This autoencoder, trained on genuine transactions, learns a latent representation and flags deviations during reconstruction as potential fraud. This research investigates two key questions: (1) How effectively can a GNN with an attention mechanism detect and prevent credit card fraud when applied to a heterogeneous graph? (2) How does the efficacy of the autoencoder with attention approach compare to traditional methods? The results are promising, demonstrating that the proposed model outperforms benchmark algorithms such as Graph Sage and FI-GRL, achieving a superior AUC-PR of 0.89 and an F1-score of 0.81. This research significantly advances fraud detection systems and the overall security of financial transactions by leveraging GNNs with attention mechanisms and addressing class imbalance through an autoencoder.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChaotic Variational Auto Encoder based One Class Classifier for Insurance Fraud Detection

Yelleti Vivek, Vadlamani Ravi, K. S. N. V. K. Gangadhar et al.

Crowdsourcing Fraud Detection over Heterogeneous Temporal MMMA Graph

Hui Li, Qihang Sun, Jieming Shi et al.

Forgetting Prevention for Cross-regional Fraud Detection with Heterogeneous Trade Graph

Xin Yang, Fan Zhou, Qiang Gao et al.

Ethereum Fraud Detection with Heterogeneous Graph Neural Networks

Xin Liu, Toyotaro Suzumura, Hiroki Kanezashi et al.

No citations found for this paper.

Comments (0)