Summary

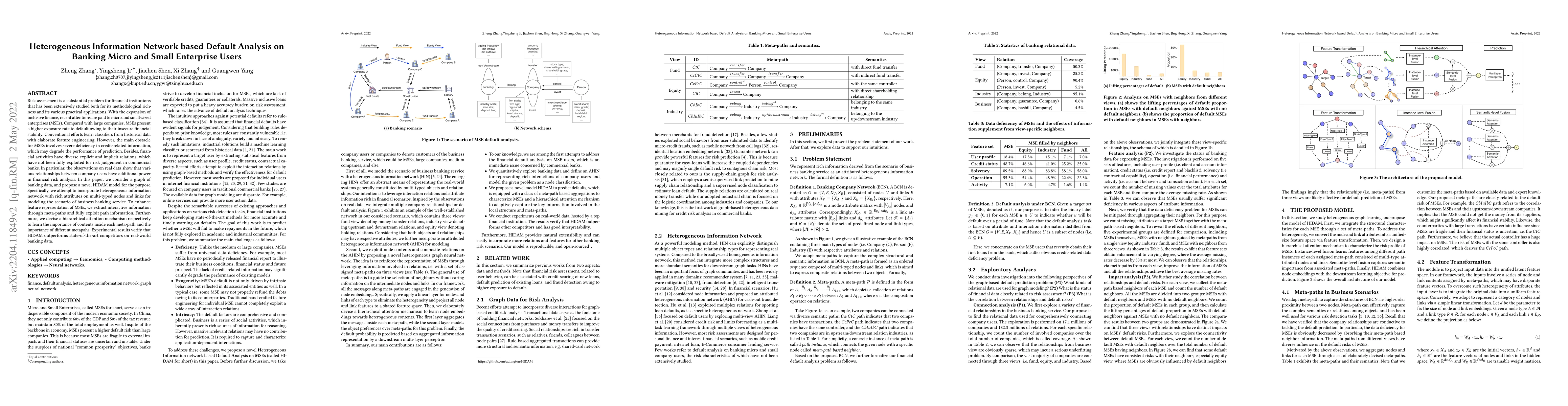

Risk assessment is a substantial problem for financial institutions that has been extensively studied both for its methodological richness and its various practical applications. With the expansion of inclusive finance, recent attentions are paid to micro and small-sized enterprises (MSEs). Compared with large companies, MSEs present a higher exposure rate to default owing to their insecure financial stability. Conventional efforts learn classifiers from historical data with elaborate feature engineering. However, the main obstacle for MSEs involves severe deficiency in credit-related information, which may degrade the performance of prediction. Besides, financial activities have diverse explicit and implicit relations, which have not been fully exploited for risk judgement in commercial banks. In particular, the observations on real data show that various relationships between company users have additional power in financial risk analysis. In this paper, we consider a graph of banking data, and propose a novel HIDAM model for the purpose. Specifically, we attempt to incorporate heterogeneous information network with rich attributes on multi-typed nodes and links for modeling the scenario of business banking service. To enhance feature representation of MSEs, we extract interactive information through meta-paths and fully exploit path information. Furthermore, we devise a hierarchical attention mechanism respectively to learn the importance of contents inside each meta-path and the importance of different metapahs. Experimental results verify that HIDAM outperforms state-of-the-art competitors on real-world banking data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)