Summary

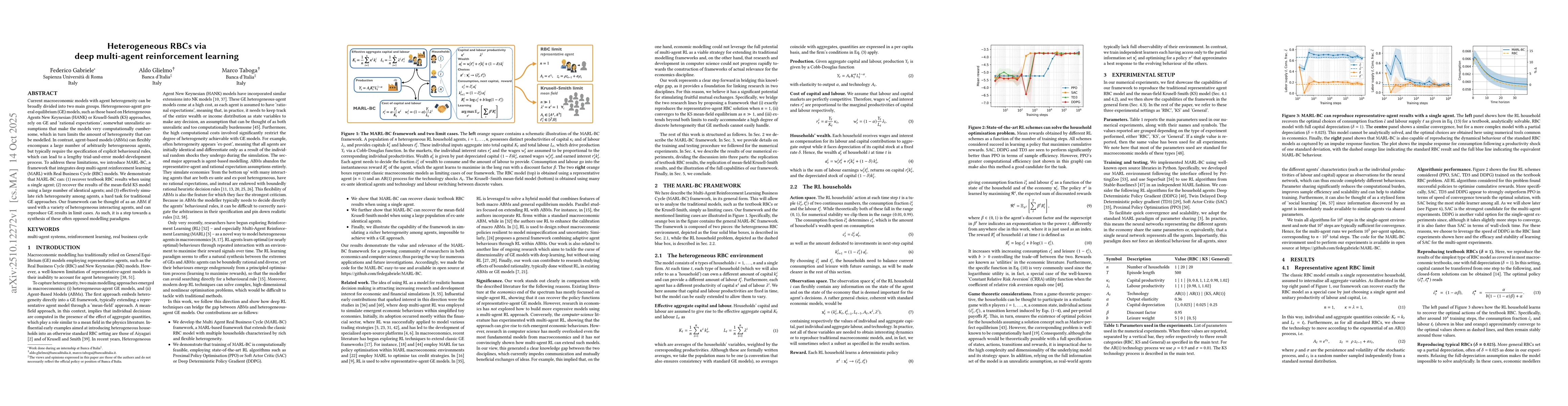

Current macroeconomic models with agent heterogeneity can be broadly divided into two main groups. Heterogeneous-agent general equilibrium (GE) models, such as those based on Heterogeneous Agents New Keynesian (HANK) or Krusell-Smith (KS) approaches, rely on GE and 'rational expectations', somewhat unrealistic assumptions that make the models very computationally cumbersome, which in turn limits the amount of heterogeneity that can be modelled. In contrast, agent-based models (ABMs) can flexibly encompass a large number of arbitrarily heterogeneous agents, but typically require the specification of explicit behavioural rules, which can lead to a lengthy trial-and-error model-development process. To address these limitations, we introduce MARL-BC, a framework that integrates deep multi-agent reinforcement learning (MARL) with Real Business Cycle (RBC) models. We demonstrate that MARL-BC can: (1) recover textbook RBC results when using a single agent; (2) recover the results of the mean-field KS model using a large number of identical agents; and (3) effectively simulate rich heterogeneity among agents, a hard task for traditional GE approaches. Our framework can be thought of as an ABM if used with a variety of heterogeneous interacting agents, and can reproduce GE results in limit cases. As such, it is a step towards a synthesis of these often opposed modelling paradigms.

AI Key Findings

Generated Oct 30, 2025

Methodology

The research employs a multi-agent reinforcement learning framework to model heterogeneous agent interactions in economic systems, using both mean-field and grid-based heterogeneous agent models. It combines policy gradient methods with empirical validation through simulation experiments.

Key Results

- SAC achieves consistent high rewards across all population sizes in mean-field models

- PPO shows slower convergence but improves performance with larger populations

- TD3 and DDPG exhibit instability and variance in large population settings

Significance

This work advances economic modeling by enabling scalable analysis of heterogeneous agent behavior, providing insights into macroeconomic dynamics and policy design through reinforcement learning techniques.

Technical Contribution

Development of a scalable multi-agent reinforcement learning framework for economic modeling with heterogeneous agents

Novelty

Integration of reinforcement learning with mean-field and grid-based heterogeneous agent models for economic analysis, enabling new insights into macroeconomic dynamics through simulation experiments

Limitations

- Computational complexity increases significantly with larger populations

- The mean-field assumption may not capture all real-world economic complexities

Future Work

- Exploring more complex economic environments with heterogeneous agents

- Investigating the impact of different reward structures on policy convergence

Paper Details

PDF Preview

Similar Papers

Found 5 papersHeterogeneous Multi-Agent Reinforcement Learning via Mirror Descent Policy Optimization

Mohammad Mehdi Nasiri, Mansoor Rezghi

Heterogeneous-Agent Reinforcement Learning

Yaodong Yang, Jiaming Ji, Yifan Zhong et al.

Comments (0)