Authors

Summary

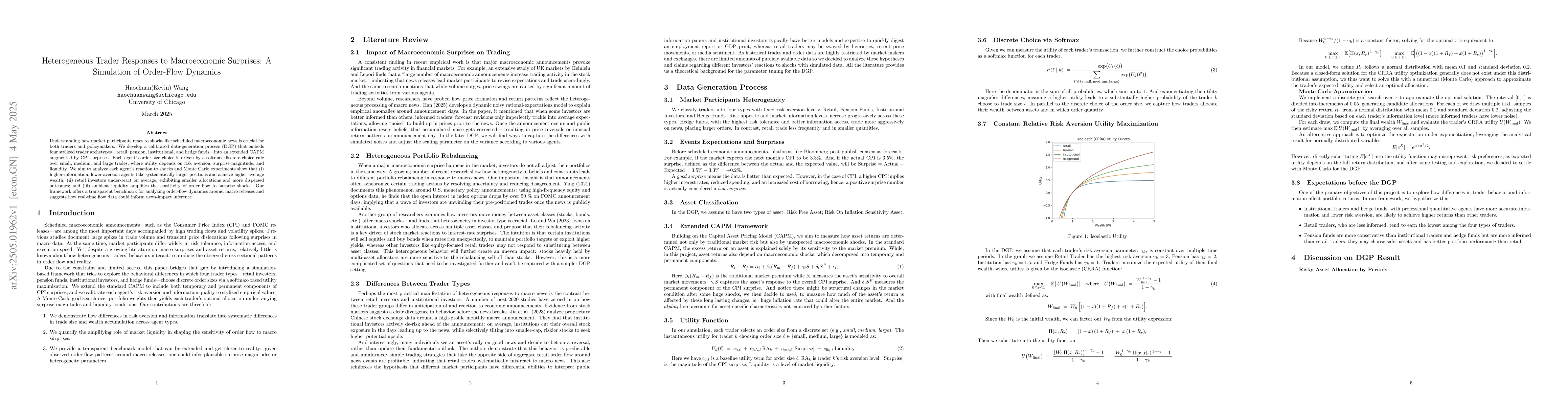

Understanding how market participants react to shocks like scheduled macroeconomic news is crucial for both traders and policymakers. We develop a calibrated data generation process DGP that embeds four stylized trader archetypes retail, pension, institutional, and hedge funds into an extended CAPM augmented by CPI surprises. Each agents order size choice is driven by a softmax discrete choice rule over small, medium, and large trades, where utility depends on risk aversion, surprise magnitude, and liquidity. We aim to analyze each agent's reaction to shocks and Monte Carlo experiments show that higher information, lower aversion agents take systematically larger positions and achieve higher average wealth. Retail investors under react on average, exhibiting smaller allocations and more dispersed outcomes. And ambient liquidity amplifies the sensitivity of order flow to surprise shocks. Our framework offers a transparent benchmark for analyzing order flow dynamics around macro releases and suggests how real time flow data could inform news impact inference.

AI Key Findings

Generated May 28, 2025

Methodology

The research employs a calibrated data generation process (DGP) that incorporates four trader archetypes (retail, pension, institutional, and hedge funds) into an extended CAPM, factoring in CPI surprises. It uses a softmax discrete choice rule for order size selection, with utility depending on risk aversion, surprise magnitude, and liquidity.

Key Results

- Higher information and lower risk aversion agents take larger positions and achieve higher average wealth.

- Retail investors underreact on average, exhibiting smaller allocations and more dispersed outcomes.

- Ambient liquidity amplifies the sensitivity of order flow to surprise shocks.

Significance

This framework provides a transparent benchmark for analyzing order flow dynamics around macroeconomic releases and suggests how real-time flow data could inform news impact inference, benefiting both traders and policymakers.

Technical Contribution

The paper presents an extended CAPM framework that accounts for both traditional market risk and unexpected macroeconomic shocks, decomposing asset returns into temporary and permanent components.

Novelty

The research introduces a heterogeneous agent DGP that simulates trader behavior under macroeconomic shocks, offering a novel approach to understanding order flow dynamics and the impact of varying trader information and risk aversion levels.

Limitations

- The model relies on simplifying assumptions that may not fully capture real-world complexities, such as a two-asset structure and static risk aversion.

- Return distribution assumptions do not account for skewness, fat tails, and volatility clustering observed in many financial assets.

Future Work

- Incorporate a richer asset space with dynamic correlations and heterogeneous risk profiles.

- Model dynamic risk aversion based on market feedback and trader adaptation instead of assuming constant risk aversion levels.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimulating Macroeconomic Expectations using LLM Agents

Jianhao Lin, Lexuan Sun, Yixin Yan

EconAgent: Large Language Model-Empowered Agents for Simulating Macroeconomic Activities

Qingmin Liao, Yong Li, Chen Gao et al.

No citations found for this paper.

Comments (0)