Summary

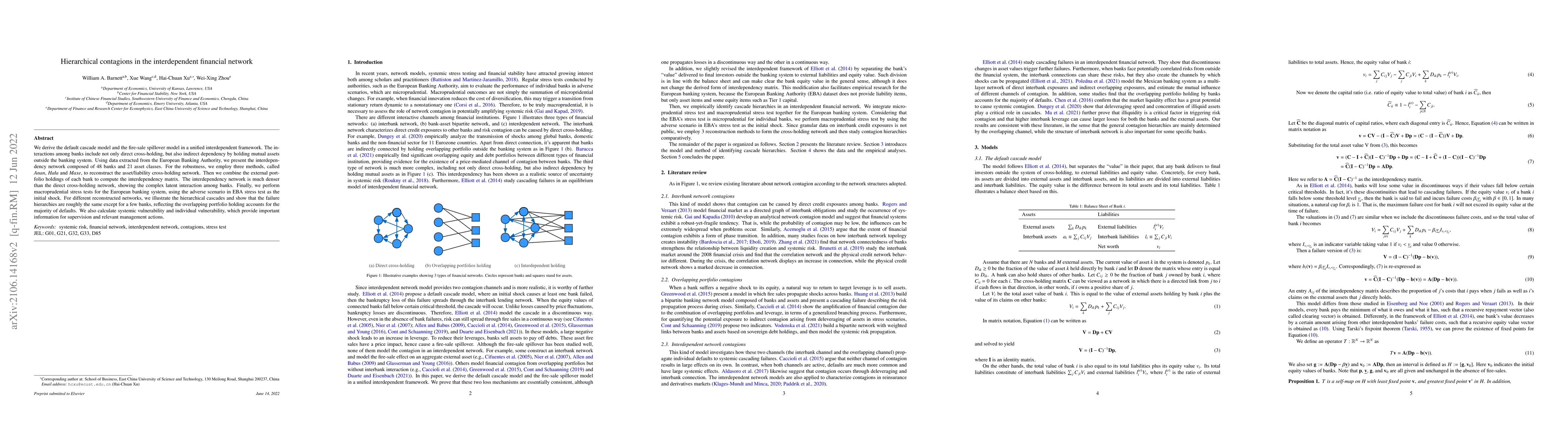

We derive the default cascade model and the fire-sale spillover model in a unified interdependent framework. The interactions among banks include not only direct cross-holding, but also indirect dependency by holding mutual assets outside the banking system. Using data extracted from the European Banking Authority, we present the interdependency network composed of 48 banks and 21 asset classes. For the robustness, we employ three methods, called $\textit{Anan}$, $\textit{Ha\l{}a}$ and $\textit{Maxe}$, to reconstruct the asset/liability cross-holding network. Then we combine the external portfolio holdings of each bank to compute the interdependency matrix. The interdependency network is much denser than the direct cross-holding network, showing the complex latent interaction among banks. Finally, we perform macroprudential stress tests for the European banking system, using the adverse scenario in EBA stress test as the initial shock. For different reconstructed networks, we illustrate the hierarchical cascades and show that the failure hierarchies are roughly the same except for a few banks, reflecting the overlapping portfolio holding accounts for the majority of defaults. We also calculate systemic vulnerability and individual vulnerability, which provide important information for supervision and relevant management actions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComplex contagions can outperform simple contagions for network reconstruction with dense networks or saturated dynamics

Jean-Gabriel Young, Nicholas W. Landry, William Thompson et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)